Right here’s a segment from the Empire newsletter. To read fleshy editions, subscribe.

Let’s be ravishing: Ethereum’s no longer having an ultimate time. Segment of it, as I wrote the day old to this, is as a result of total lack of momentum for altcoins. There’s also ravishing a lack of determined sentiment — which is unlike what we’re seeing for bitcoin (even supposing it hovers below $100,000).

In my conversation with Amberdata’s Greg Magadini, one part that used to be neglected of the day old to this’s edition had been his thoughts on ETH.

“The skedaddle on ETH, in my thoughts, is for the explanation that mark proposition of EIP-1559 creating a provide burn used to be made invalidated, or used to be invalidated once everyone started constructing their L2s and app chains and having all of the transactions process off Ethereum and opt abet to Ethereum. So then you flip from a deflationary asset to an inflationary asset. That’s a elementary cause within the abet of ETH occurring,” he explained.

In varied phrases, ETH’s inability to bag momentum is by hook or by crook tied to the remaining of the market ravishing now — especially no longer the memecoin craze.

Okay so this wasn’t my most determined intro, but I in point of truth wanted to hold more of a determined interrogate at Ethereum ravishing now thanks to a Galaxy document from Vice President of Research Christine Kim.

The document is centered on what’s being constructed on Ethereum and is a pleasing refresher — or interior interrogate — to interrogate how initiatives are the utilization of it.

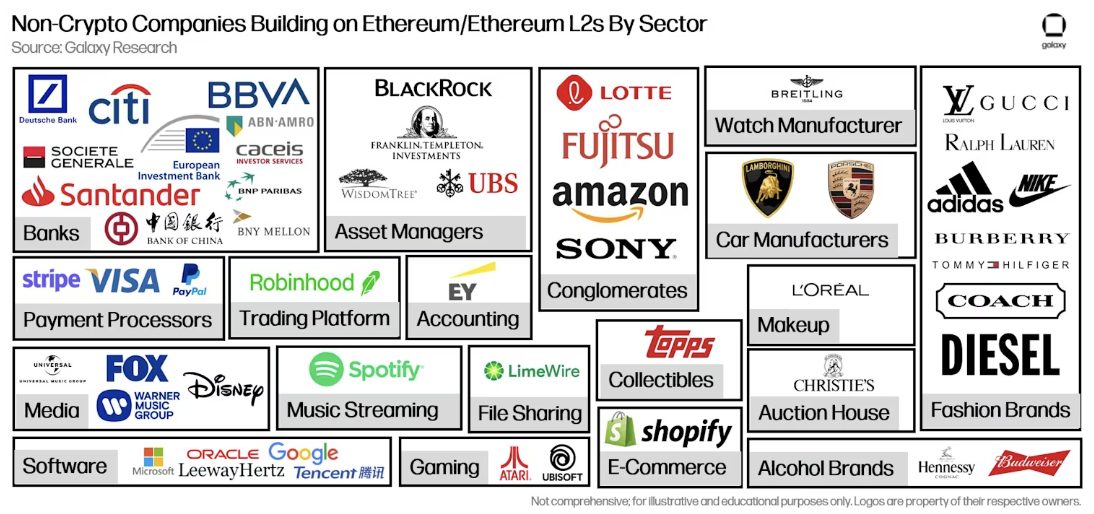

Kim noted that over 50 non-crypto companies gain constructed both on Ethereum or an Ethereum L2. That’s no exiguous quantity, especially whenever you dig in and find that about 20 of them are monetary institutions with 10 of these being banks.

The largest utilize case, which ought to near as no surprise to staunch Empire readers, is exact-world sources. That’s the effect you are going to need got the monetary institutions constructing and experimenting with tokenized sources — just like money market funds (judge BlackRock or Franklin Templeton) or authorities bonds.

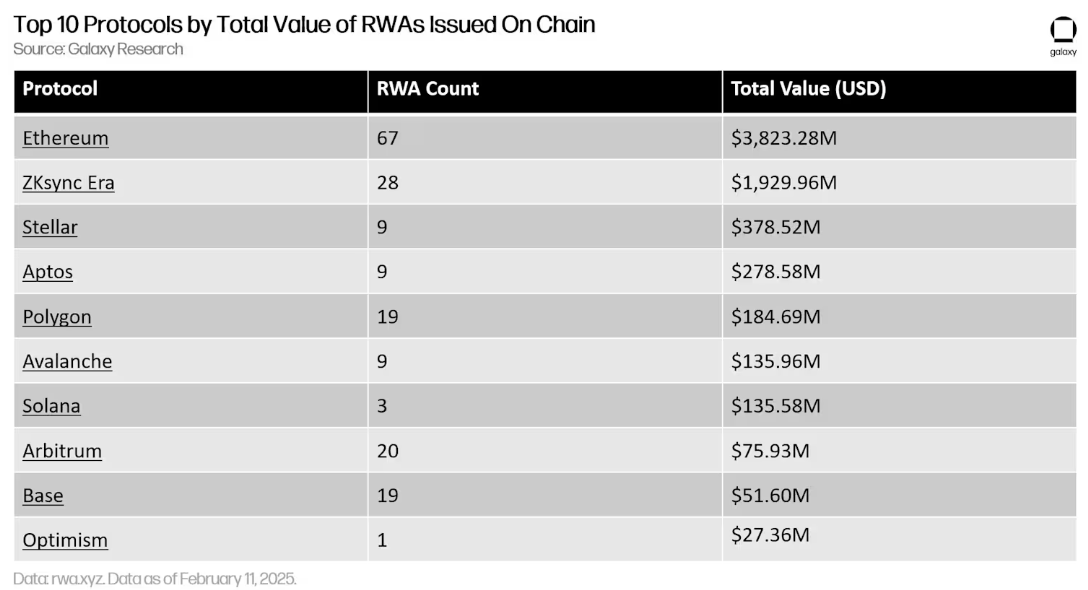

As viewed below, Ethereum more than doubles the series of RWAs issued by Ethereum L2 rollup ZKSync.

Now I know that RWAs aren’t the sexiest utilize case for crypto — and I bag it — but I judge we can all agree that they mutter about a of the promise of crypto for non-crypto natives (as prolonged as we protect them away from the memecoins).

Nonetheless, k, let’s circulate on to one other utilize case Galaxy learned: gaming on Ethereum L2s.

NFTs haven’t made a comeback, meaning that about a of the companies that attempted to bag some crypto publicity through them stopped issuing them years within the past. Excellent enough. Nonetheless Galaxy learned that on the mutter time, there is a utilize case for NFTs for some non-crypto native companies and that’s gaming.

“What’s most principal regarding the ongoing funding and vogue of NFTs by non-crypto-native companies be pleased Atari, Lamborghini, and Lotte’s Caliverse is that they’re being developed within the context of a larger on-chain gaming software,” Kim wrote.

“This highlights how the scalability beneficial properties from L2s are serving to to attend crypto-native utilize conditions that require frequent on-chain interactions be pleased gaming amongst main retail brands and companies,” she continued.

There are silent a form of questions and concerns about Ethereum and the effect it goes from right here, and that’s one thing I’m determined we’ll be covering again soon. Nonetheless Galaxy’s document reveals that we’re silent seeing a form of constructing occurring, and it’s attracted of us start air of crypto. And that, I judge, is a exiguous determined.