-

FET could perhaps perhaps doubtless also fly 45% to attain $1.10 in the arrival days

-

FET merchants are over-leveraged at $0.731 on the lower aspect and $0.785 on the upper aspect.

-

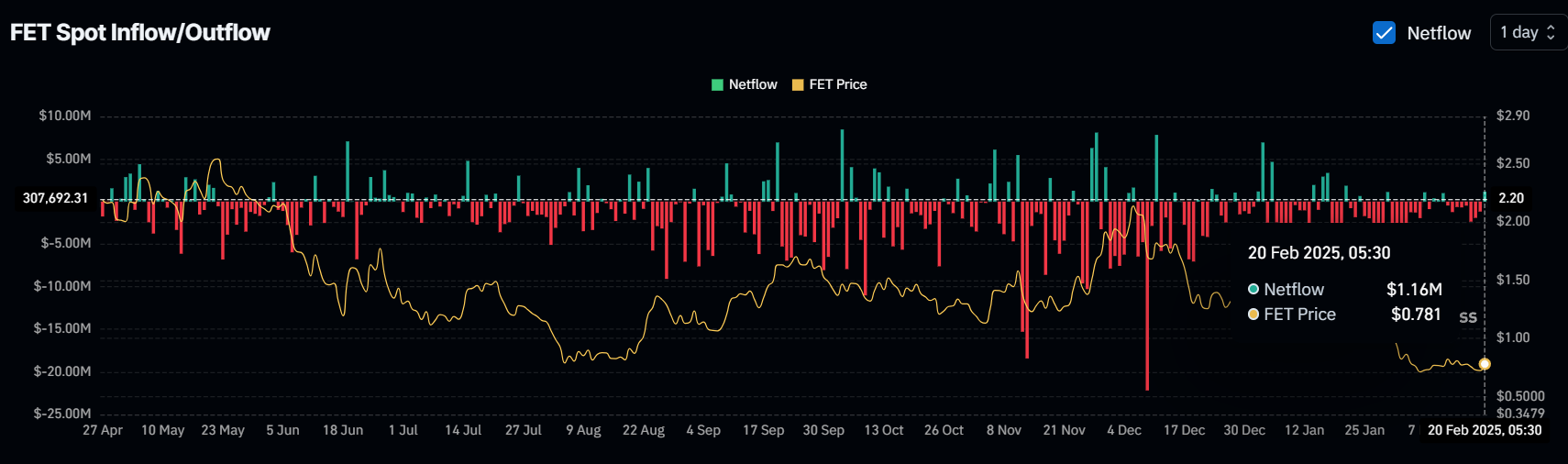

On-chain metrics point out that exchanges indulge in witnessed an outflow of roughly $1.50 million fee of FET tokens

After witnessing a 65% heed fall over the final two months, the Artificial Superintelligence Alliance (FET) looks ready for takeoff, supported by bullish heed motion on each and each weekly and each day time frames. With an ongoing heed restoration, FET tokens are gaining critical attention from merchants and merchants, which would possibly perhaps perhaps doubtless also attend the asset rebound soon.

Contemporary Designate Momentum

Today, February 21, 2025, FET is trading terminate to $0.778 after surging over 9.50% previously 24 hours. Within the course of the identical interval, its trading volume elevated by 17%, indicating growing hobby from merchants and merchants when put next with yesterday.

FET Technical Prognosis and Upcoming Ranges

Per CoinPedia’s technical prognosis, FET looks bullish and is poised for critical upside momentum, as its technical indicators are flashing a bullish divergence on the weekly timeframe. Additionally, FET looks to be forming a bullish double-bottom heed motion pattern and is at the moment on the verge of finishing its second upward leg.

In response to ancient patterns, if the asset holds above the $0.70 stage, there is a actual possibility it could possibly perhaps perhaps doubtless also surge by 45% to attain $1.10 in the arrival days and by 165% overall to reclaim the $2.05 stage, which FET misplaced in December 2024.

Traders Bearish Outlook

Regardless of bullish momentum, some merchants are offloading FET, as reported by the on-chain analytics agency Coinglass. Recordsdata unearths that exchanges indulge in witnessed an outflow of roughly $1.50 million fee of FET tokens, suggesting that some holders indulge in equipped off their positions.

Major Liquidation Ranges

Meanwhile, merchants having a bet on the long aspect are at the moment dominating the asset. At press time, the over-leveraged ranges are $0.731 on the lower aspect and $0.785 on the upper aspect, where merchants indulge in constructed thousands and thousands fee of long and short positions. Recordsdata reveals that merchants take care of $1.03 million fee of long positions at the $0.731 stage and $270,000 at the $0.785 stage.

When combining these on-chain metrics, it looks that some merchants are making the loads of the present market sentiment, whereas others, driven by fear, are dumping the asset.