Crypto narratives continue to shift, with Computerized Market Makers (AMMs), trading bots, and perpetuals rising as key developments this week. AMM protocols love UNI, CAKE, and PENDLE are gaining momentum, fueled by Uniswap’s Unichain launch and BNB’s energy.

Buying and selling bots remain extremely winning, with Photon and BullX generating more prices than Ethereum within the final seven days. Meanwhile, perpetuals platforms are seeing renewed hobby, with HYPE main the category and Hyperliquid placing ahead its dominance in earnings abilities.

Computerized Market Makers (AMMs)

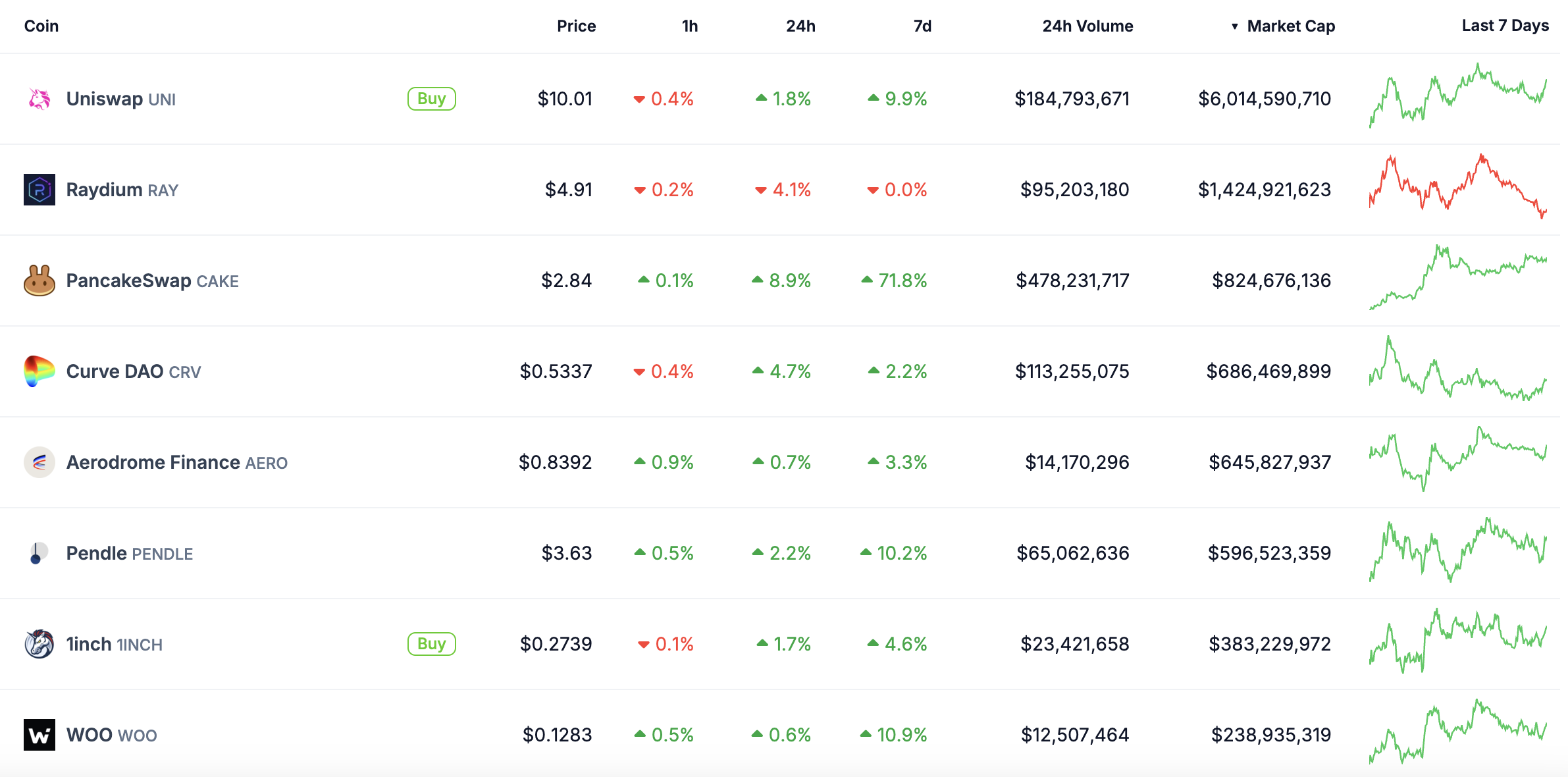

UNI, CAKE, PENDLE, and WOO possess all risen within the previous week making it one of basically the most neatly-liked crypto narratives for the time being. Uniswap’s launch of Unichain strengthens its ecosystem, whereas BNB’s momentum has fueled CAKE’s 70% surge.

If these catalysts persist, AMM protocols might maybe well witness further beneficial properties.

Computerized Market Makers (AMMs) are decentralized protocols that enable trading without expose books, using liquidity swimming pools as a change. Traders swap sources against these swimming pools, whereas liquidity suppliers intention prices.

RAY has moved sideways however stays extremely winning, generating $270 million in prices in 30 days. No matter Solana’s downtrend, a resurgence in Solana meme coins might maybe well force renewed hobby in RAY. Its solid fundamentals possess it positioned for a capability breakout.

Buying and selling Bots

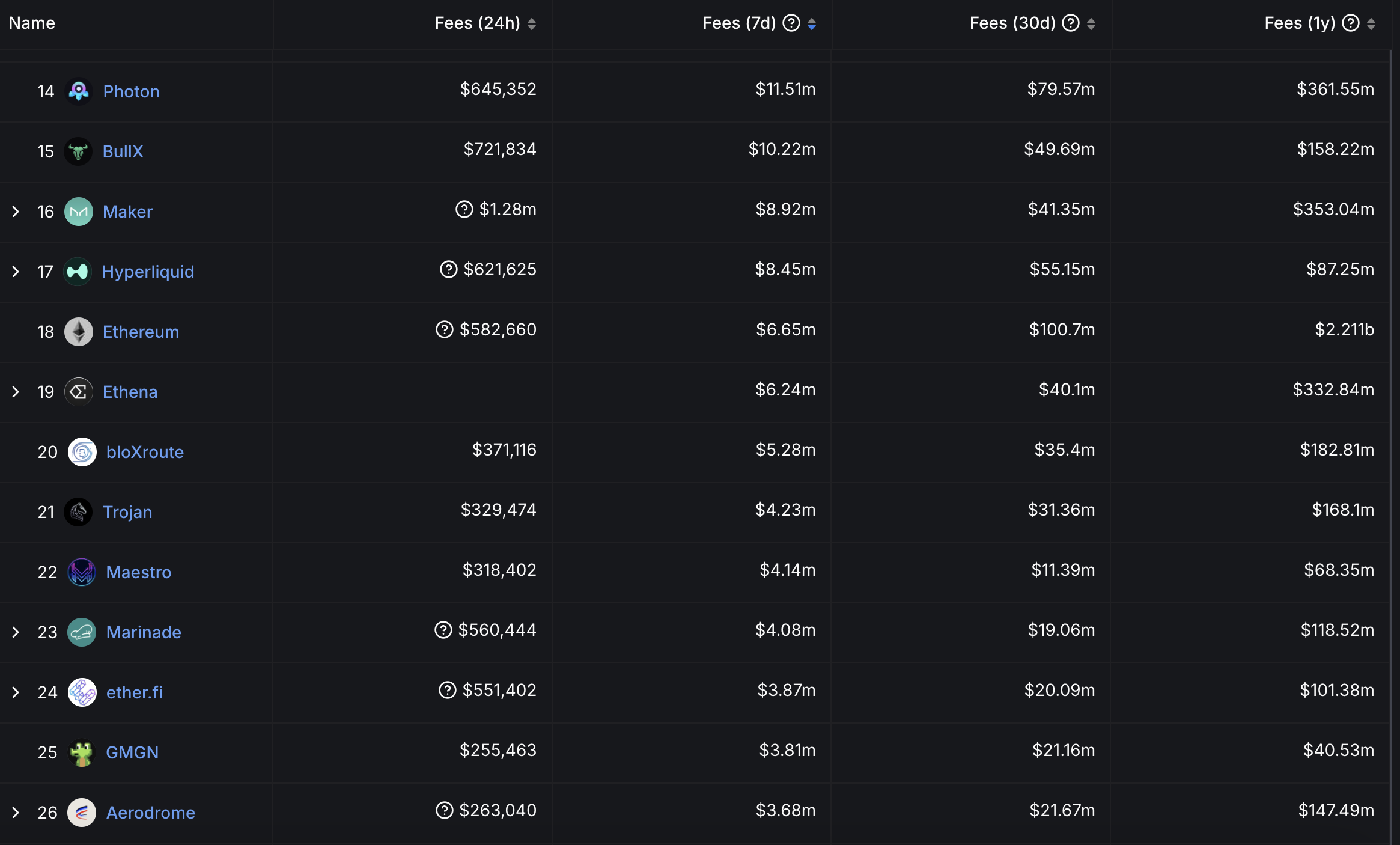

Buying and selling bots were one of the largest crypto narratives for the reason that discontinue of 2023, as these purposes continue to generate loads of earnings and attract tons of of thousands of customers per day. Five of them deplorable within the slay 25 for earnings among all crypto protocols.

Crypto Buying and selling Bots are automatic purposes that impact aquire and sell orders primarily based on predefined solutions, laying aside the need for handbook trading. Merely about all of them are primarily based on Telegram, even supposing some additionally possess desktop alternatives.

Within the final seven days, Photon and BullX generated over $10 million in prices, surpassing Ethereum, which made $6.6 million.

Assorted bots, reminiscent of Trojan, Maestro, and GMGN, are additionally thriving. Every generated over $3 million in prices within the previous week.

No matter Solana’s stamp decline, trading bots continue to plan customers. With more coins being created every day and a few analysts predicting 1 billion coins by 2030, these bots are unlikely to sluggish down, which might maybe well attend coins love BONK and BANANA, that are associated to BonkBot and BananaGun trading bots.

Perpetuals

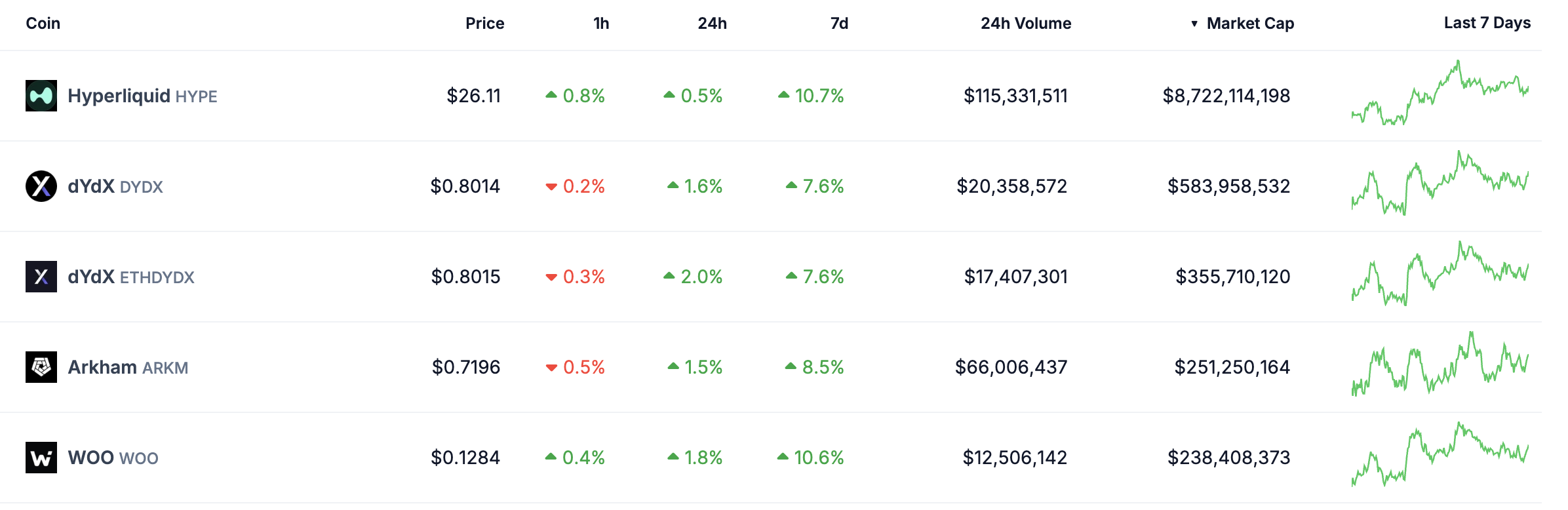

Perpetuals coins seem poised for a rebound, with the slay five all gaining within the previous week. HYPE leads the pack, up more than 10% in seven days. This momentum signals growing hobby within the field after HYPE struggled for some weeks.

Perpetuals platforms exchanges that enable traders to alternate perpetual futures contracts without an expiration date. These platforms enable customers to rob long or short positions with leverage, using a funding mechanism to lend a hand contract prices aligned with the plight market.

Hyperliquid stays the dominant power in perpetuals, generating $8.Forty five million in prices in precisely the final week.

HYPE is the sure chief, with a market cap and earnings bigger than all assorted gamers combined. Then again, this dominance suggests room for opponents to emerge, genuine as came about with trading bots. As soon as managed by BONK, BANANA, and Maestro, the market later saw Trojan, BullX, and Photon fabricate principal floor.