Solana’s tag stays in a include market after falling over 33% from its three hundred and sixty five days-to-date high, with technical indicators pointing to a deeper decline.

Solana (SOL) token crashed to $184 on Monday and is hovering shut to its lowest stage since February 2nd.

This downturn coincides with stalled network enhance and concerns about rug pulls within its meme coin ecosystem. CoinGecko knowledge shows that the market cap of all Solana meme coins has crashed from over $25 billion in January to $11.5 billion this day.

Most Solana meme coins hold dropped by double digits from their all-time highs. Official Trump (TRUMP) has plunged from $103 in January to $18 this day. Within the same contrivance, tokens esteem Fartcoin, ai16z, Gigachad, and Popcat hold all declined by over 15% previously seven days.

A typical pattern in the Solana ecosystem entails developers launching meme coins, artificially inflating their rate, exiting, and leaving many traders with losses. As an instance, Donald Trump’s insiders profited because the TRUMP token surged, with many cashing out forward of the give contrivance. As a consequence, concerns are growing in regards to the prolonged-term viability of the meme coin ecosystem.

This pattern has affected the quantity traded in Solana’s decentralized change protocols esteem Raydium, Orca, and Jupiter has retreated. The total quantity dropped by almost 25% in the final seven days to $26.21 billion. It has been overtaken by BNB Chain, which handled almost $30 billion in that point.

Another signal of a slowdown in the Solana network is the decline in stablecoin activity. The total stablecoin provide on Solana fell by $772 million previously seven days, while Ethereum’s elevated by $1.1 billion over the identical duration. Here is critical, as stablecoins are the dear medium of change in the blockchain change.

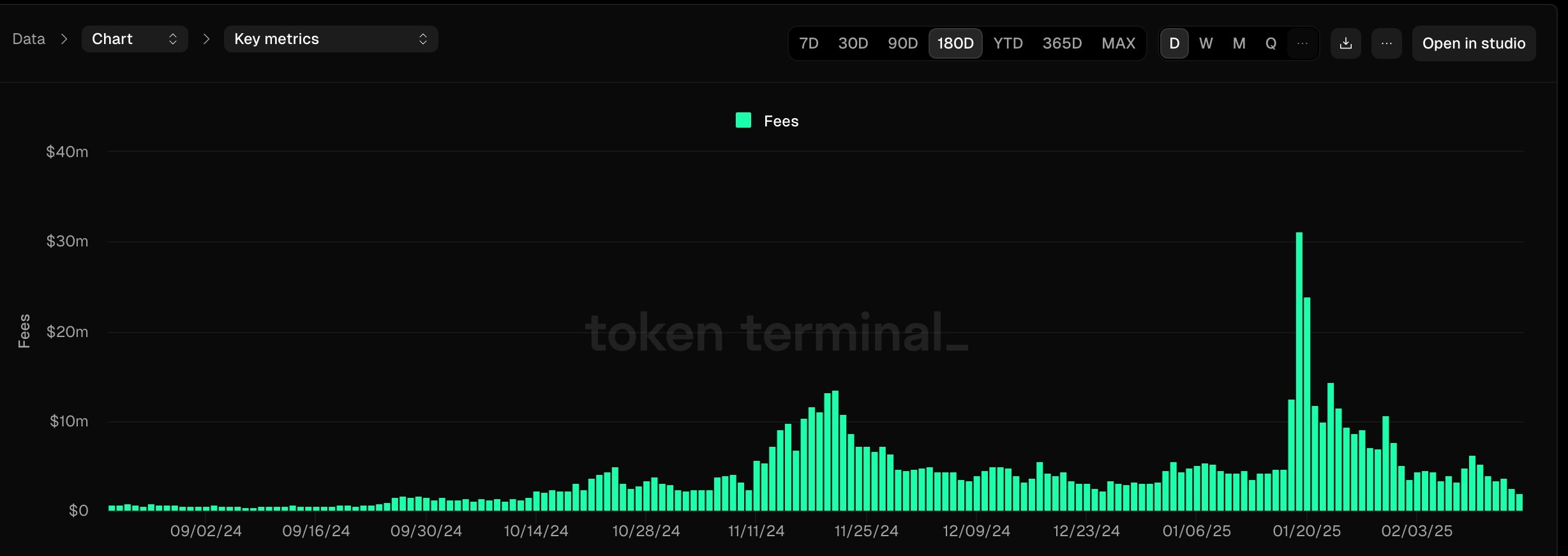

Further knowledge shows that charges generated in the future of the Solana ecosystem hold plunged in most modern weeks. Day-to-day charges fell from a height of $31 million in January to steady $2 million on Monday.

Solana tag technical diagnosis

The everyday chart shows that SOL’s tag has declined after reaching a high of $300 in January. It has now dropped to a really considerable toughen stage, struggling to transfer under the ascending trendline that has linked its lowest swings since August 2023.

Solana is nearing a death spoiled sample, with the 50-day and 200-day weighted transferring averages on the verge of a bearish crossover. It’s far additionally drawing procedure $170, the neckline of a double-top sample fashioned at $265.

If SOL falls under $170, there is a risk of a bearish breakdown to $110, representing a 40% decline from most modern levels.