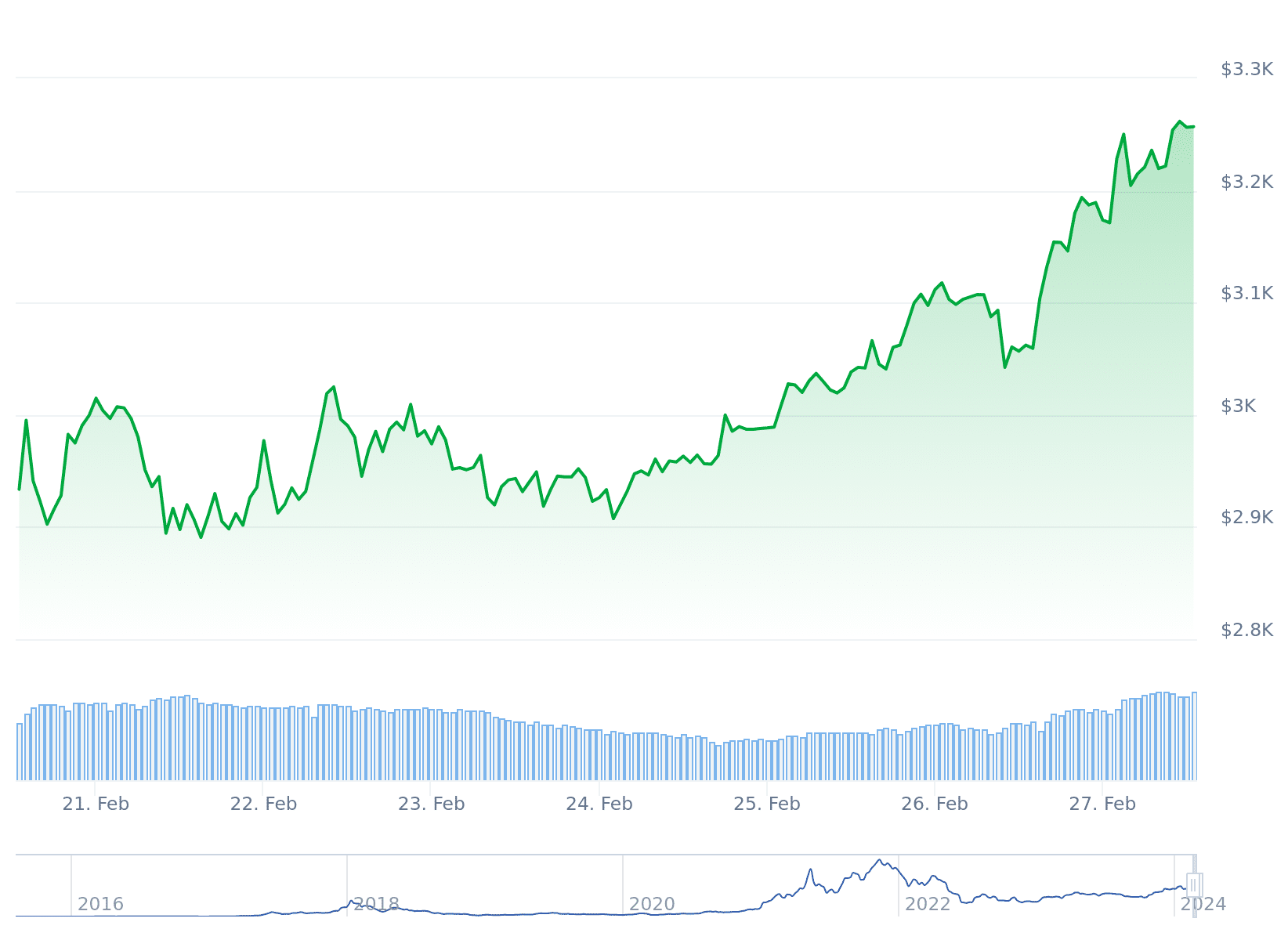

Ethereum establish is barely 33% from its all-time excessive of $4,878 after rallying to a 22-month top of $3,278. The 2nd-largest crypto has persevered to lift a bullish outlook aside from the short consolidation in early January.

Both technical and predominant indicators display cloak the next breakout, with ETH likely to delivery out establish discovery soon.

In the last 24 hours, ETH establish has sustained a 3% expand in price, 11% in per week, 24% in a fortnight, and 44% in 30 days, underscoring definite investor sentiment.

Elements Igniting The Ethereum Impress Rally

The Ethereum Dencun pork up stands out as indubitably one of many forces backing the bullish image in ETH establish. This protocol pork up, scheduled for March 13 guarantees key enhancements no longer only for Ethereum however additionally for the brilliant layer 2 solutions worship Arbitrum and Polygon, that would salvage pleasure from diminished transaction costs by a characteristic called proto-danksharding.

Dencun will additionally expand the blockchain block measurement from the sizzling 12.5 MB to 25 MB to pork up more transactions per block for efficient network throughput.

A brand recent transaction format will additionally be enabled with the implementation of the Dencun pork up. This can simplify the validation course of and, at the identical time, pork up the developer ride when building applications.

Immediate: 3 Layer 1 Crypto To Aquire For March As Bitcoin Tops $57,000

After the successful implementation of the Dencun pork up, the hype for a situation ETF will are available in plump swing. Ethereum establish prolonged the rally after the approval of Bitcoin ETFs in January as merchants turned their attention to the $390 billion token.

An Ethereum ETF will display screen the price of the crypto in staunch time, offering merchants tell exposure to ETH without facing the complex nature of the crypto market worship navigating exchanges and storage.

The approval of the ETF will rate the increasing adoption of Ethereum as a legitimate asset class. Consultants and industry idea leaders have expressed their optimism for the doubtless greenlighting of the situation ETH ETF.

The CEO of Grayscale Investments, Michael Sonnenshein only in the near previous expressed his self belief in the Securities and Trade Price (SEC) approving the ETF.

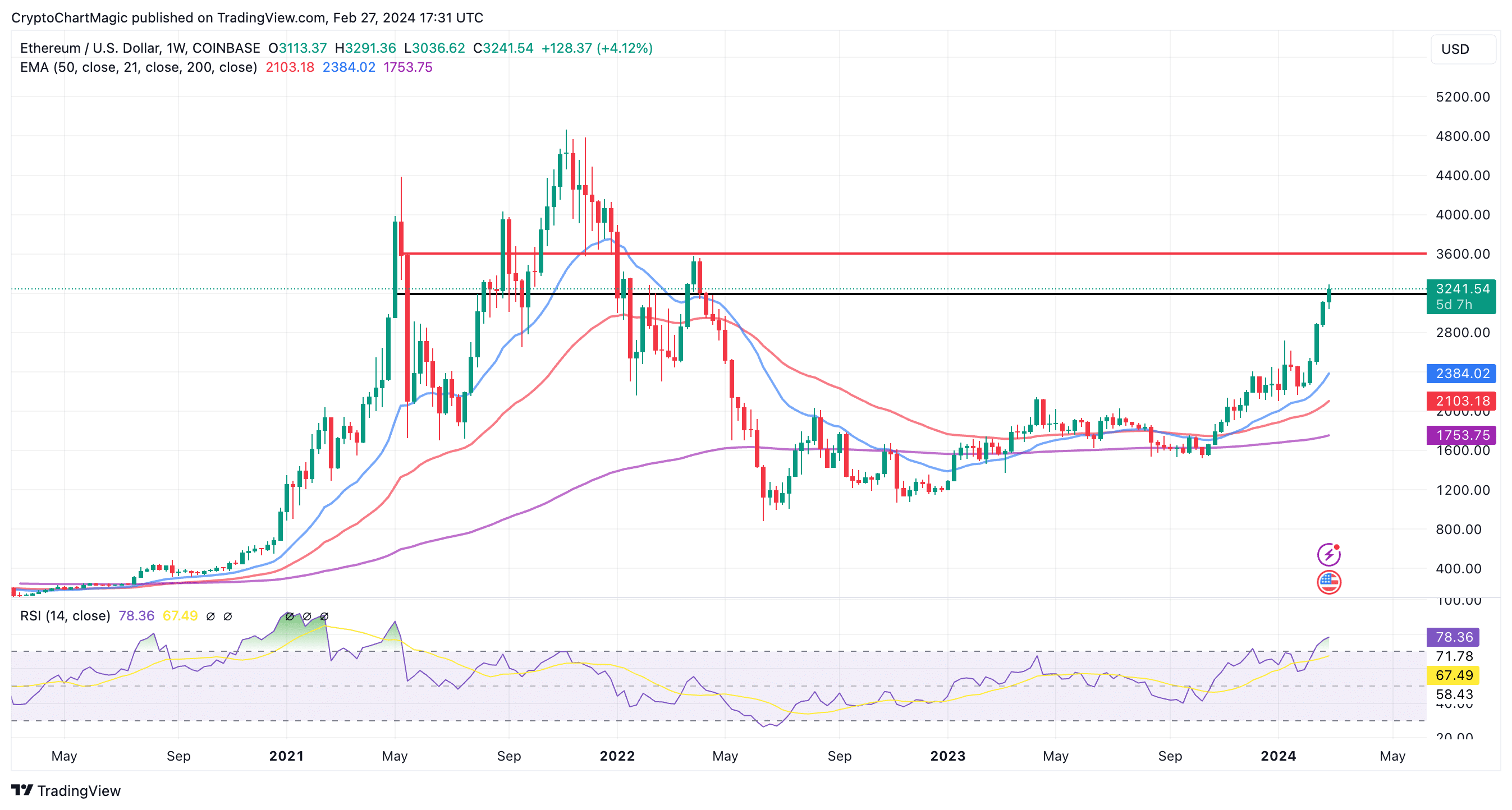

Assessing ETH Impress Technical Building

The jam of the Relative Strength Index (RSI) at 78 in the overbought dwelling methodology that merchants help the reins for the time being. In the meantime, bulls could well be in the hunt for a weekly shut above $3,200 or the unlit horizontal ray on the chart to regular the uptrend.

With the continued consolidation above $3,200 pork up, re-accumulation is location to occur offering Ethereum establish the momentum it requires to aid transferring greater.

Though highly no longer in reality, corrections to or below $3,000 sooner than the Dencun pork up would location off predominant aquire-the-dips strikes amongst merchants who could well be speculating on the following surge to $3,600 (well-known weekly resistance).

Connected Articles

- What’s the Toll road Ahead for Pepe Coin Impress After Surpassing $0.000002?

- LUNC Impress: Terra Classic Ready To ‘Swallow’ 1 Zero As Market Cap Nears $1B

- Is Pyth Community (PYTH) Impress Heading to $1? Hedera Integration and Unusual Listings Enhance Momentum