Bitcoin sellers are facing challenges in breaking beneath the critical 100-day transferring moderate at $96K, resulting in half of market indecision.

This line remains a key battleground between bulls and bears, as trace action round this threshold is expected to dictate the following main trend.

Technical Analysis

By Shayan

The Each day Chart

Bitcoin sellers proceed to wrestle to ruin beneath the main 100-day transferring moderate at $96K, a historically critical toughen diploma where merchants agree with continually stepped in. This zone remains a critical battleground, as a successful protection by merchants may maybe doubtless perhaps additionally feature off renewed search recordsdata from, using the asset toward the pivotal $103K resistance.

Nevertheless, bearish risks persist, as a decisive breakdown beneath this toughen may maybe doubtless perhaps additionally spark liquidations in the futures market, intensifying selling stress. Till a sure breakout occurs, merchants must brace for heightened volatility and appealing trace swings within this fluctuate.

The 4-Hour Chart

On the decrease timeframe, BTC remains trapped within a bullish continuation flag, with trace action exhibiting indicators of uncertainty. The decrease boundary of this pattern has equipped non everlasting toughen, nonetheless a decisive push above the $100K resistance is main to substantiate bullish momentum toward the $108K all-time excessive.

Despite optimism surrounding this formation, hunting for energy remains insufficient to gas a breakout, underscoring the want for stronger search recordsdata from. More than one toughen zones beneath doubtlessly the most up-to-the-minute trace provide a buffer in opposition to design back risks, growing the chance of a rebound. If bullish momentum strengthens, the following key milestone ceaselessly is the psychologically critical $100K diploma.

Sentiment Analysis

By Shayan

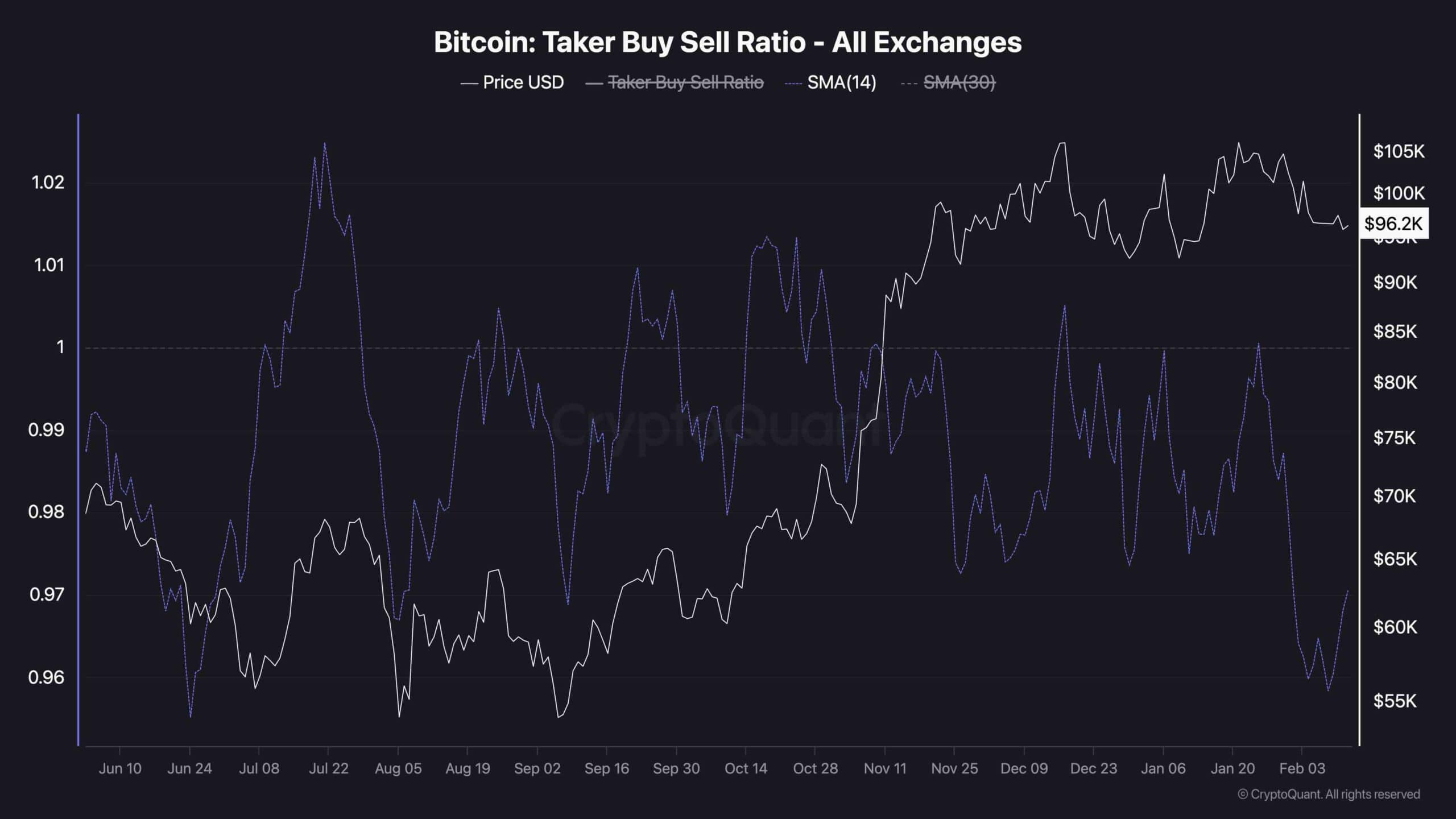

Bitcoin’s fresh indecisive trace action has left investors questioning what’s stopping the market from sustaining its upward momentum. A more in-depth study at futures market metrics presents treasured insights.

The Bitcoin taker aquire-promote ratio, which displays whether or now not merchants or sellers are inserting more aggressive market orders, presents a doubtless clarification. As depicted in the chart, the 14-day transferring moderate of this metric has confirmed a bullish reversal following a critical decline. This shift means that merchants are regaining energy and must quickly rob non-public watch over of the futures market.

If this trend continues and the ratio surpasses the 1.0 threshold, it would signal an inflow of hunting for stress, potentially fueling the momentum main for a renewed bullish rally.