Right here’s a section from the Empire publication. To read corpulent editions, subscribe.

Right here’s the notify about strategic reserves.

The title implies that no topic is within the reserve is a stockpile that can furthermore be utilized one day within the long lumber when the topic calls for it.

Within the US, the authorities maintains a stockpile of a million barrels of diesel fuel spread between Massachusetts, Contemporary Jersey and Connecticut — a trove of oil to be launched to warmth properties and companies must there be a offer disruption somewhere down the twin carriageway.

A strategic grain reserve does powerful the the same notify, but for a serious meals ingredient.

They attain no longer necessarily must straight profit the present public, either. At one point, the authorities change into also stockpiling helium, hoarding it for use in militia blimps, although for the time being the inside of most sector handles that, and the helium as an different is frail for rockets and superconductors.

So what would a strategic crypto reserve with out a doubt be for? What future calamity might perchance a portfolio of random cash abet alleviate?

A bitcoin-most effective strategic reserve is the most life like to sq.. As a ways as cash spin, it’s obviously the most immune to valuable long-timeframe corrections — it has continuously bounced support from its semi-typical 80% drawdowns.

BTC is also effectively uncorrelated with the remaining of the crypto market — because it nearly continuously leads it. That makes it the evident possibility for a strategic reserve.

After all, bitcoin’s main in type use case is inquiring for and maintaining long-timeframe, which is ready as halt to an overarching just for any strategic reserve as we’ve got without delay. Perchance one day within the long lumber, on some rainy day, the US might perchance promote its bitcoin one thing, pay off some debt or otherwise fund initiatives for the present accurate.

The closest things we possess now got without delay to a US strategic crypto reserve are the $20 billion BTC seized by criminal cases over time — which is serene heading within the accurate route to be liquidated one day, although perchance no longer within the fast timeframe.

Then, there’s the growing strategic reserve maintained by Trump’s upcoming DeFi venture World Liberty Fi. It’s up to now spent $303 million on seven completely different cash since the tip of November, as honest no longer too long within the past as final week, with merely about two-thirds of it going to ETH.

Monitoring the charge of World Liberty Fi’s reserve is more worthy after it moved most of it into Coinbase Top custody earlier this month. Nevertheless after piecing collectively the onchain info, I calculated that the portfolio change into value precise over $261 million earlier this morning.

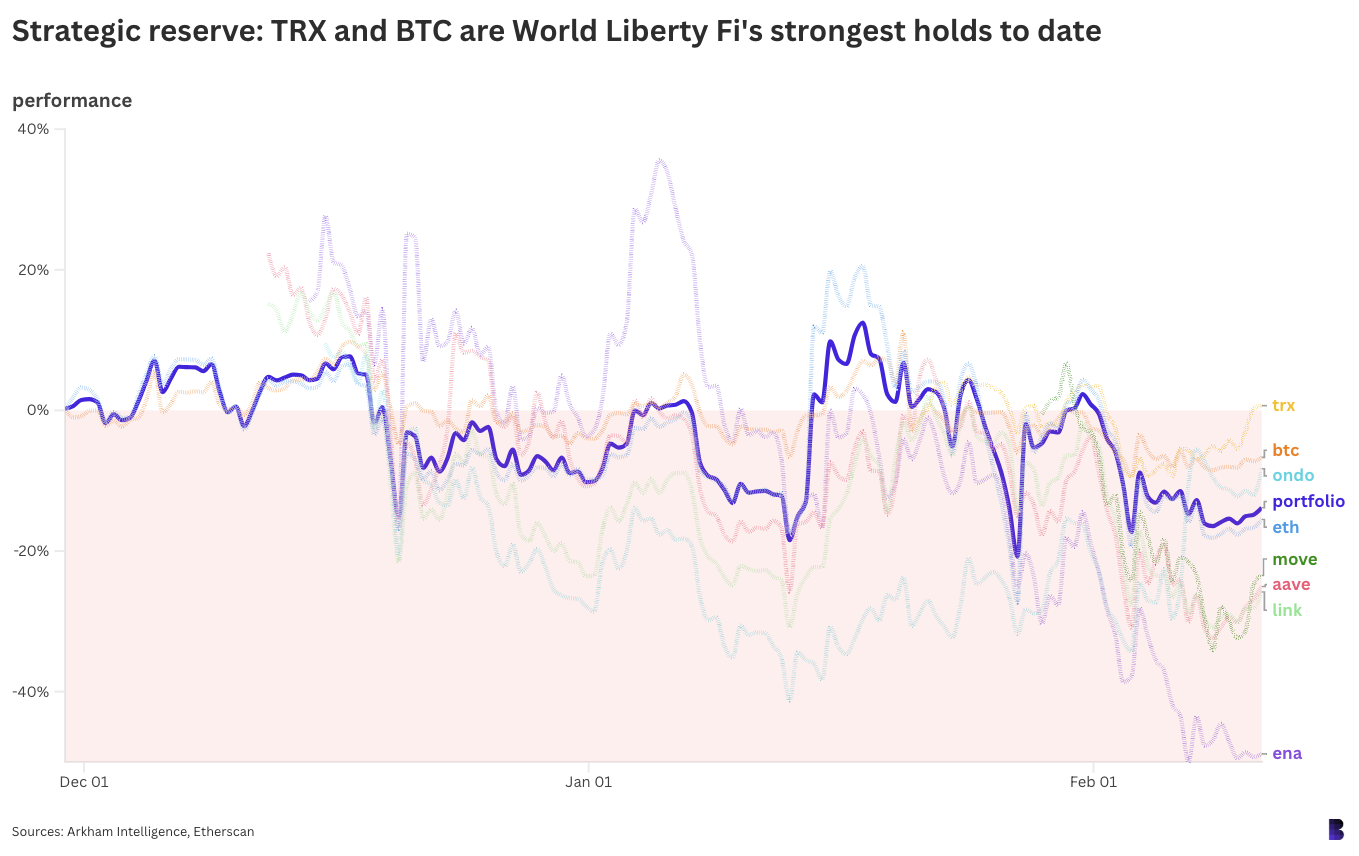

That places it within the pink by about 14% on all of its purchases up to now (as shown by the blue line on the chart above, whereas the opposite lines whisper the general efficiency of every web enlighten online).

TRX is the most attention-grabbing care for serene inexperienced, but most effective barely, with ENA the worst — World Liberty Fi is down around $2.7 million on its ENA positions without delay. The portfolio is basically being held up by bitcoin, with it down around $30 million in its ETH when in comparison with $5 million on BTC.

Perchance there’s no reason for World Liberty Fi’s strategic reserve to exist in any appreciate, other than frequent treasury administration current to many crypto projects, now to no longer demonstrate the reported token swap deals relayed by Lightspeed’s Jack Kubinec.

Nevertheless if it with out a doubt turns out that World Liberty Fi’s crypto portfolio is if truth be told Trump’s anticipated strategic reserve, then this also can merely must be actively managed, namely as we safe nearer to the next endure market.

If World Liberty Fi’s portfolio drops extra, labeling it as “strategic” might perchance safe embarrassing.