Cardano has confronted principal volatility and promoting stress because the broader crypto market struggles to study sturdy wait on ranges. Since early December, Cardano has dropped over 61%, with its label action reflecting a continual downtrend that has shaken investor self belief. Irrespective of just a few attempts, the label has yet to indicate obvious indicators of reversing the bearish momentum that has dominated its efficiency all the design thru the final months.

Presently, Cardano is trading at a principal stage, one which must preserve to spark a attainable commerce in its market trajectory. The significance of this stage can no longer be overstated, as losing it might probably probably per chance consequence in extra declines and heightened uncertainty for ADA customers. However, hope remains on the horizon for Cardano bulls.

High crypto analyst Ali Martinez has shared a promising technical signal, revealing that Cardano is beginning to indicate indicators of a attainable rebound on the each day chart. In accordance with Martinez, key indicators are aligning to indicate that a restoration would be in the making, offering a glimmer of optimism for merchants and long-term holders alike. The approaching days shall be needed for Cardano, as it remains at a crossroads that might resolve whether the most novel pattern continues or a grand-fundamental rebound at final takes shape.

Cardano May maybe maybe per chance Launch A Restoration

Cardano would be on the verge of a restoration rally as it finds sturdy query at most novel ranges, with bears unable to push the label into decrease query zones. After months of continual promoting stress and bearish sentiment, Cardano appears to be like to be to be stabilizing, creating a probability for bulls to build up preserve watch over. However, reclaiming key ranges above the $0.72 tag shall be serious to confirming the initiate up of a meaningful restoration.

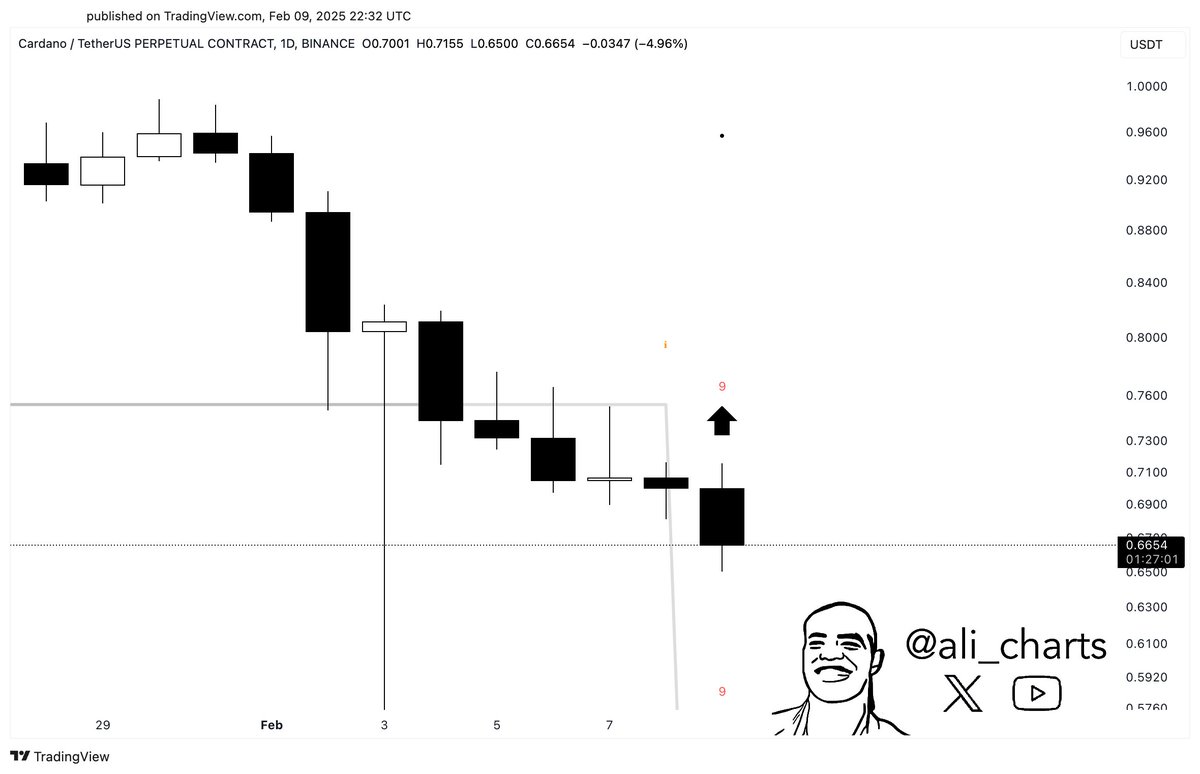

Including to this optimism, prime analyst Ali Martinez currently shared a technical signal on X, indicating that Cardano shall be poised to rebound. Martinez highlighted that the TD Sequential indicator has flashed a purchase signal on the each day chart, a model that has caught the attention of many ADA customers. The TD Sequential is a widely dilapidated technical prognosis instrument designed to identify attainable label reversals and points of pattern exhaustion, making it a treasured indicator throughout volatile market conditions.

This obvious signal offers a glimmer of hope for Cardano customers who were ready for a rally, no longer beautiful for ADA but additionally all the design thru the altcoin market. If bulls can preserve the most novel query stage and push the label above $0.72, a restoration rally might design momentum in the arriving weeks.

Breaking thru this key stage and sustaining increased prices will likely entice extra customers and gas bullish sentiment, potentially marking the initiate up of a brand recent upward pattern. However, failure to reclaim key ranges might consequence in prolonged consolidation or extra declines, making the following few days needed for Cardano’s label trajectory.

ADA Stamp Testing Wanted Inquire of

Cardano (ADA) is for the time being trading at $0.69 after enduring days of advertising and marketing stress and heightened volatility. Final Monday’s dramatic 38% tumble, adopted by an spectacular 60% restoration, showcased the intensity of the most novel market conditions. However, despite the swift rebound, ADA has struggled to reclaim the $0.85 stage, a principal resistance zone that bulls must overcome to study a sustainable uptrend.

For Cardano to design momentum, it is needed for bulls to preserve most novel label ranges and push the label above the 200-day exponential racy moderate (EMA), which stands at $0.7225. This EMA serves as a really crucial indicator of long-term power, and a reclaim above it would signal renewed bullish momentum. Breaking above this stage might pave the methodology for a rally, potentially bringing ADA nearer to no longer easy the $0.85 tag again.

Failing to preserve the most novel label or reclaim the 200-day EMA might consequence in extra consolidation or even one more leg down, as market sentiment remains fragile. The approaching days shall be serious for ADA as it tests its ability to preserve wait on and set up a bullish pattern. Investors will carefully sight these key ranges, as retaining and breaking above them might signal the initiate up of a restoration rally.

Featured image from Dall-E, chart from TradingView