Bitcoin has experienced important impress swings within the previous 24 hours, briefly surpassing the $100,000 mark earlier than retracing. The sudden tumble displays the continued market uncertainty, with traders reacting to transient volatility.

However, long-duration of time steadiness appears to be like taking form, largely supported by frail traders preserving onto their positions.

Bitcoin has Taken A Various Method

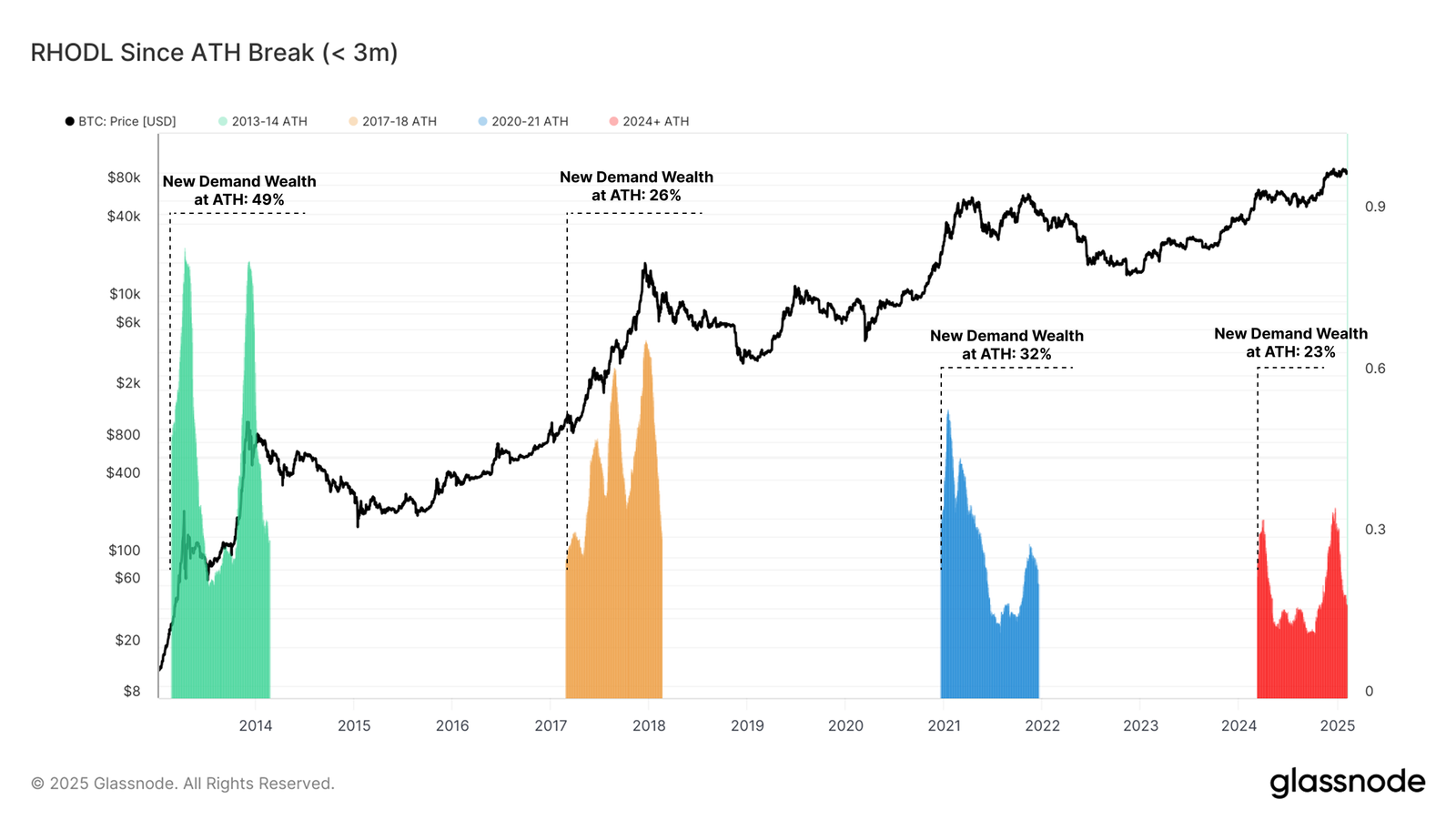

The RHODL (Realized HODL) ratio since Bitcoin’s most current all-time excessive (ATH) sits at 23%. Whereas current inquire of remains important in this cycle, the wealth held in cash older than three months is a lot lower than in outdated cycles. This implies that current inquire of inflows had been occurring in bursts moderately than in a sustained sample.

Unlike outdated market cycles, which generally concluded one one year after the first ATH spoil, the current cycle has taken an odd trajectory. Bitcoin first reached a current ATH in March 2024, yet inquire of has yet to match the stages seen in previous rallies. This deviation raises questions about how the leisure of the cycle will unfold.

Realized volatility on a 3-month rolling window remains below 50% in this cycle. In distinction, previous bull runs saw volatility stages exceeding 80% to 100%. This cut price in volatility suggests that Bitcoin’s impress motion is extra structured, with frail traders contributing to a extra stable market environment.

The 2023-25 cycle has followed a stair-stepping sample, with impress rallies followed by consolidation intervals. Unlike outdated cycles characterized by coarse swings, Bitcoin’s current trajectory exhibits indicators of boring impress will increase. This vogue helps a extra managed bull market, lowering the threat of coarse crashes.

BTC Mark Prediction: Defending Above A Mandatory Wait on

Even supposing Bitcoin’s long-duration of time outlook remains unsure ensuing from rising transient volatility, the instantaneous forecast suggests vulnerability to correction. The cryptocurrency is shopping and selling end to key crimson meat up stages, and additional declines could in all probability in all probability lead to a deeper retracement.

If Bitcoin loses the $95,869 crimson meat up diploma, it will perhaps in all probability in all probability in all probability moreover simply tumble in the direction of $93,625. Whereas BTC holders comprise shunned important revenue-taking, additional losses could in all probability in all probability residing off a wave of promoting. This disaster would establish additional rigidity on the price, extending Bitcoin’s correction.

On the other hand, a jump off $95,869 could in all probability in all probability enable Bitcoin to reclaim the $100,000 diploma. Successfully breaching this psychological barrier would invalidate the bearish outlook, potentially surroundings the stage for a renewed uptrend.