Amid this backdrop, one CryptoQuant contributor, acknowledged as caueconomy, supplied an prognosis of a significant constructing inviting Bitcoin’s alternate withdrawals.

Largest Exchange Withdrawals Since FTX Give way

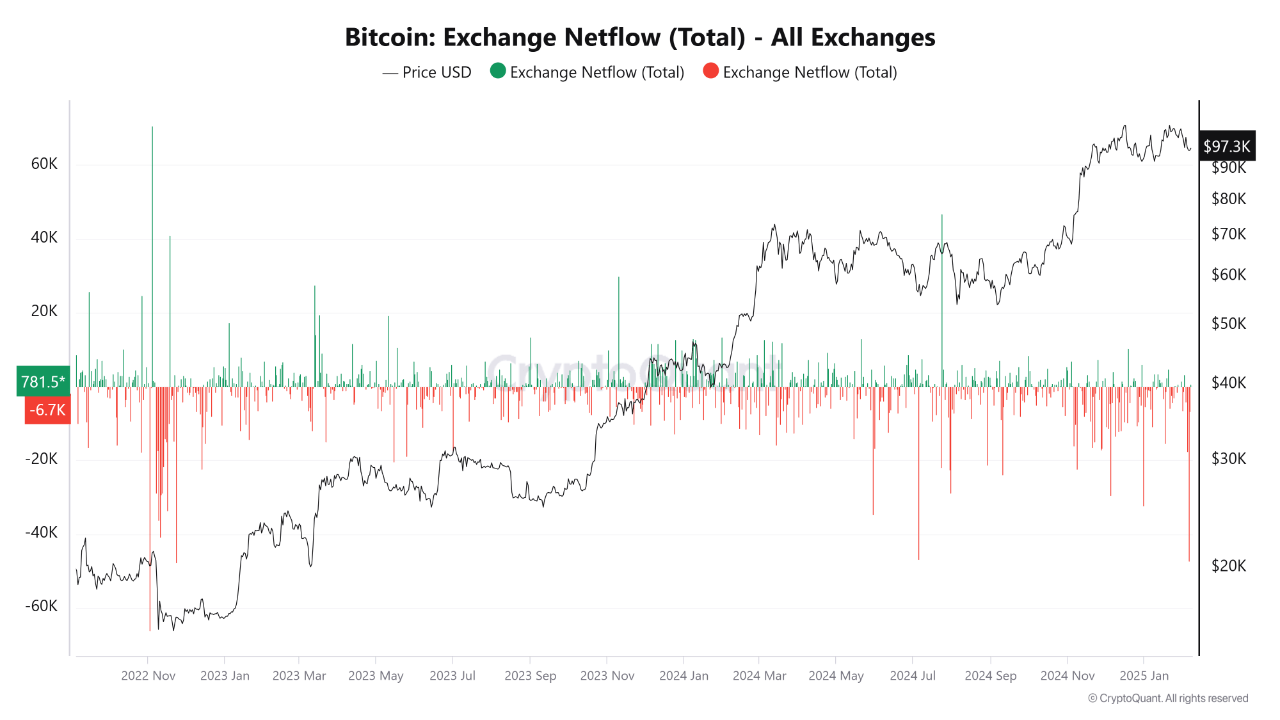

In a most modern post, caueconomy highlighted the supreme quantity of alternate withdrawals since the FTX give way. In keeping with the guidelines, over 47,000 BTC were some distance off from alternate reserves.

Whereas all these actions will be internal, they furthermore present capability accumulation by a huge market player or institutional entity. This pattern of Bitcoin transferring off exchanges on the complete indicators a lengthy-term bullish perspective, as fewer coins available for buying and selling also can consequence in diminished sell-side pressure over time.

However, the analyst clarified that this shift doesn’t create an instantaneous offer shock succesful of impacting Bitcoin’s mark within the immediate term. Instead, it parts to a unhurried accumulation allotment that also can present reinforce for future mark appreciation.

The supreme quantity of alternate withdrawals since the give way of FTX

“Whereas these withdrawals perform no longer replicate an instantaneous “offer shock” to the fee of bitcoin… it nonetheless unearths a pattern of accumulation by huge gamers.” – By @caueconomy

Full post 👇https://t.co/ZjYBijDOZp pic.twitter.com/ZEWj95wtfD

— CryptoQuant.com (@cryptoquant_com) February 7, 2025

Bitcoin Breakout On The Horizon?

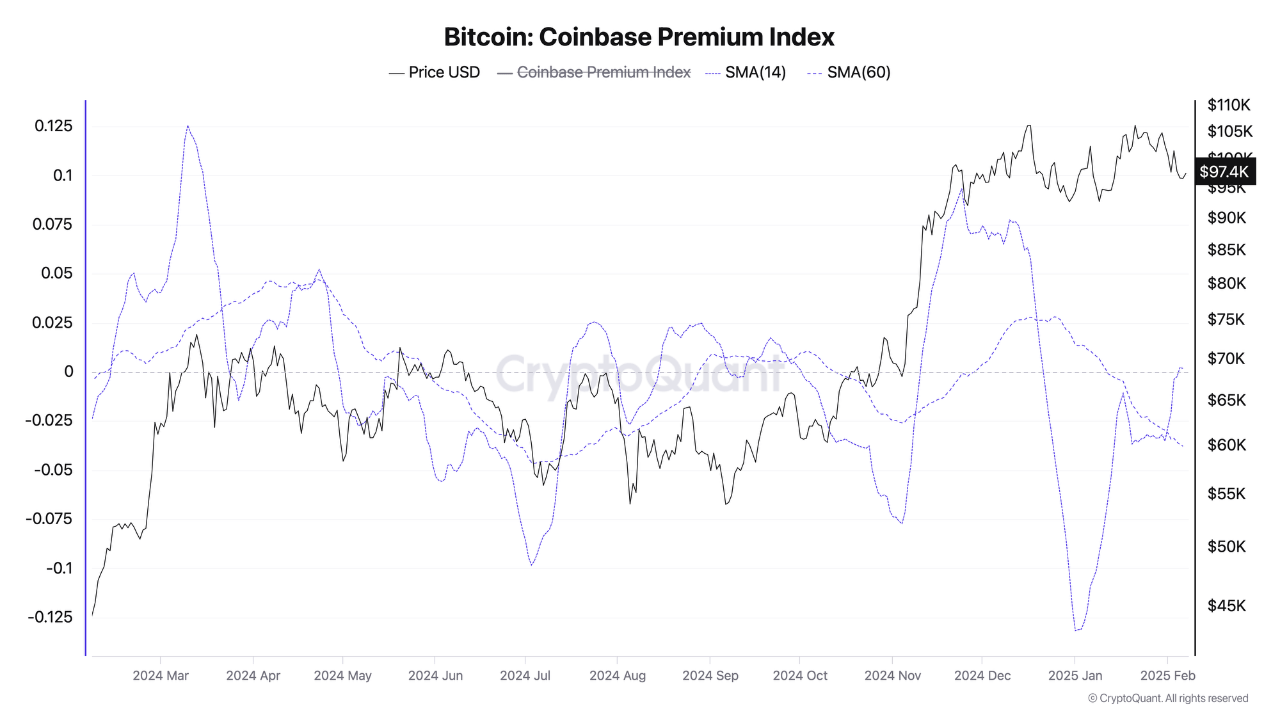

Within the intervening time, but another CryptoQuant analyst, Onatt, supplied insights into capability breakout scenarios for Bitcoin. Onatt pointed to the salvage buying for hobby captured within the Coinbase Top fee Index, a measure that compares Bitcoin’s mark on Coinbase to varied exchanges.

A certain top class continually reflects heightened query from institutional investors, suggesting that the market’s upward capability is intact. Onatt furthermore famend the crossover of key transferring averages—SMA14 and SMA60—indicating a doable fetch-up of bullish momentum.

The analyst extra highlighted Bitcoin’s rising correlation with gold and the S&P 500, indicating that the cryptocurrency’s efficiency also can align more carefully with frail possibility sources. If the broader financial markets adopt a “possibility-on” sentiment, Bitcoin also can see an upward pattern.

Additionally, Federal Reserve Chairman Jerome Powell’s most modern feedback referring to the restricted impact of employment facts on inflation enjoy helped stabilize market expectations. As lengthy as financial facts stays internal forecasted ranges, certain sentiment toward Bitcoin and varied possibility sources also can proceed to grow.

Featured picture created with DALL-E, Chart from TradingView