Cryptocurrencies are surging in a bull rally led by Bitcoin (BTC) and Ethereum (ETH) this week. The cryptocurrency market surpassed $2 trillion in total capitalization for basically the most important time in years.

In this context, some initiatives reached an overbought role at their Relative Strength Index (RSI). Subsequently, it will abet crypto investors to realize the massive positive components in the mean time accomplished in this urge.

If adequate traders identify on income realization, these overbought cryptocurrencies might maybe unexpectedly ride a retracement or correction. In step with Ralph Nelson Elliott, the market always strikes in waves of impulses and corrections.

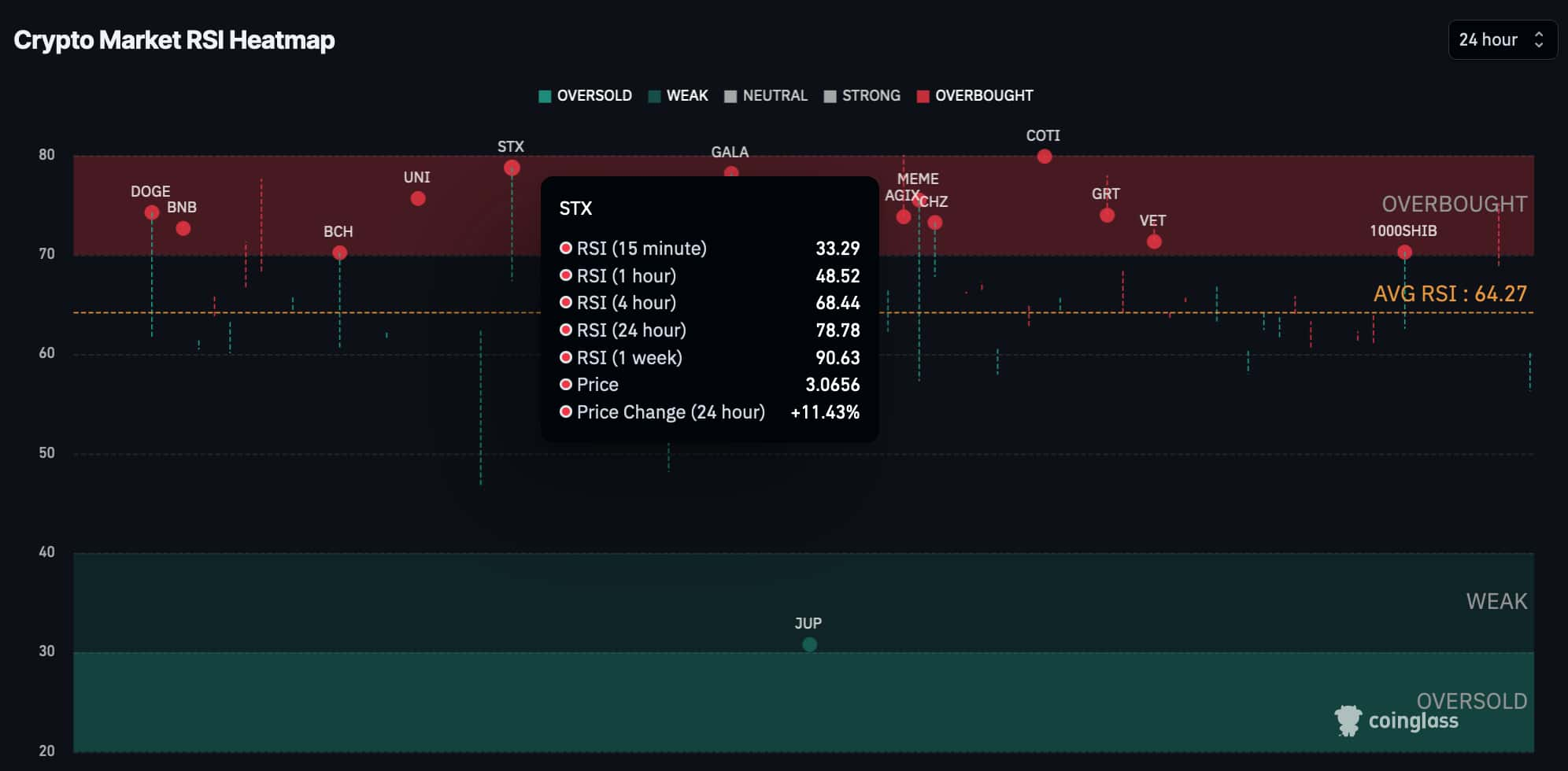

Thus, figuring out overextended sign actions might maybe inspire investors to entrance-urge these corrections, working as a precious sell signal. Finbold turned to CoinGlass‘ RSI heatmap on February 27, for an evaluation.

Promote signal to an overbought Stacks (STX)

First, Stacks (STX) trades at $3.06 by press time, up 11.43% in the closing 24 hours. Stacks is a second layer for receiving yield with Bitcoin and has strongly followed the leader in this rally.

This made STX attain the second-absolute most life like each day RSI among all cryptocurrencies at 78.78. Furthermore, it has 90.63 in the weekly index, performing as a validating sell signal for the overbought Stacks.

The weak point observed in lower time frames might maybe furthermore gas a transient sign correction. For instance, STX has a forty eight.52 hourly RSI.

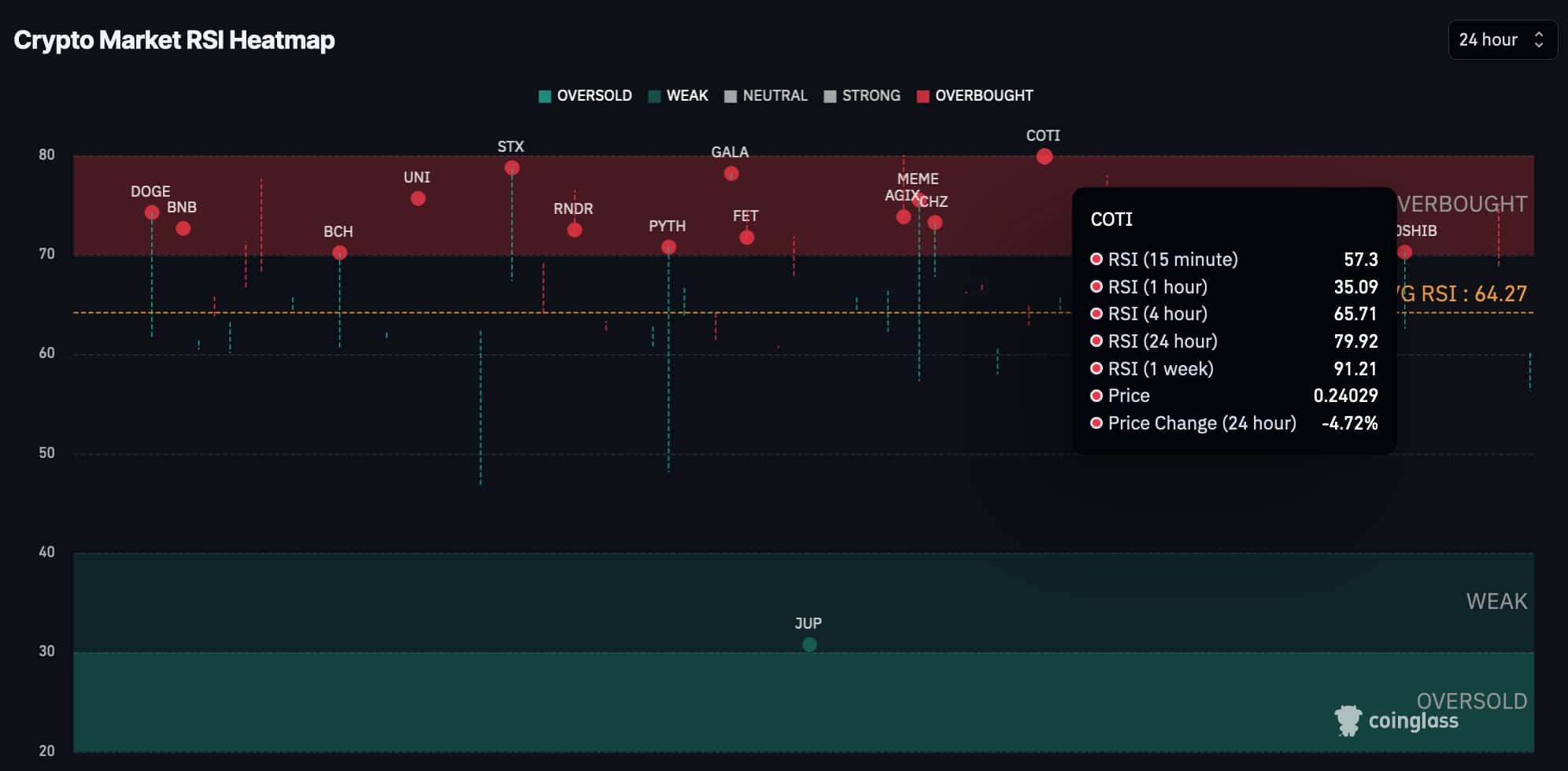

Coti (COTI) might maybe face a correction

Second, Coti (COTI) is a lower market cap cryptocurrency with even bigger overbought role. The governance token is trading at $0.24, already down 4.72% in the day.

Significantly, COTI beats STX in every the each day and weekly time frames, with seventy 9.92 and 91.21 RSIs, respectively. Label has started correcting, being an spectacular sell signal for cryptocurrency traders.

On the different hand, it’s price noting how high the favorite each day RSI is at the time of newsletter. With 64.27 points, the Relative Strength Index suggests an even momentum for cryptocurrencies, which might maybe gas continuation upwards despite the strong overbought sell indicators.

Investors must change cautiously and perceive the market is perilous and unpredictable, driven by strong sentiments of FOMO and FUD.

Disclaimer: The lisp material on this assign ought to no longer be thought to be investment recommendation. Investing is speculative. When investing, your capital is at difficulty.