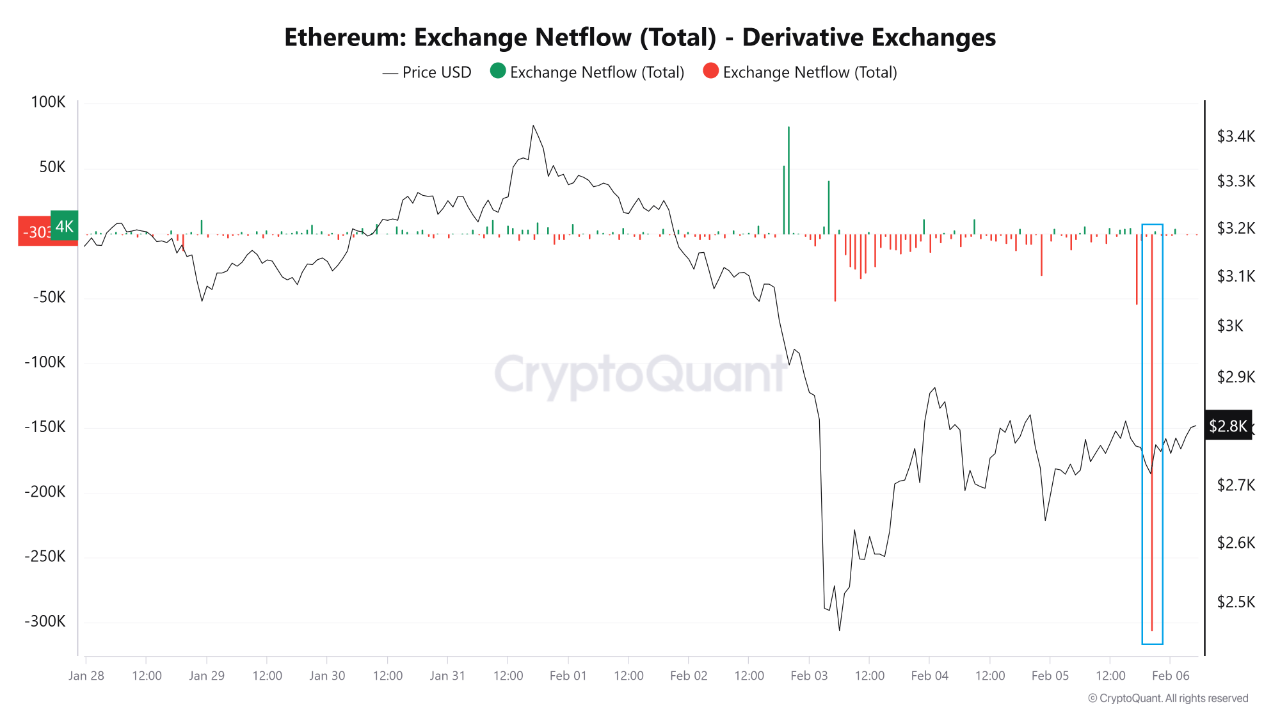

Curiously, it appears to be like there may perhaps perhaps perhaps be some notable components at the again of the scenes influencing Ethereum’s brand actions, notably the alternate netflows on derivative platforms.

Ethereum Faces Narrative Outflow: Implications

Amr Taha, a contributor on the CryptoQuant QuickTake platform, not too long ago supplied insights into the Ethereum market’s ongoing dynamics.

In an intensive put up on the QuickTake platform, Taha famed that Ethereum’s netflow on derivative exchanges dropped under -300,000 ETH for the principle time since August 2023. This notable shift, in step with Taha, holds doable implications for brand direction and market structure.

Taha outlined loads of key components to evaluate about when assessing the impact of ETH outflows on pricing. First, when wise amounts of ETH amble away derivative exchanges, it continuously alerts that traders are either closing leveraged positions or transferring funds to chilly storage.

This reduction in accessible provide can alleviate promoting stress, creating circumstances which are favorable for a brand originate bigger—offered seek files from remains steady or grows.

Nonetheless, the persona of these outflows can end result briefly-interval of time market volatility. If the withdrawals are driven by the liquidation of leveraged long positions, the market can also simply expertise a rapid-interval of time reset. While this can also simply dampen shopping for seek files from in the rapid interval of time, it continuously leads to a more wholesome and more balanced market structure over time.

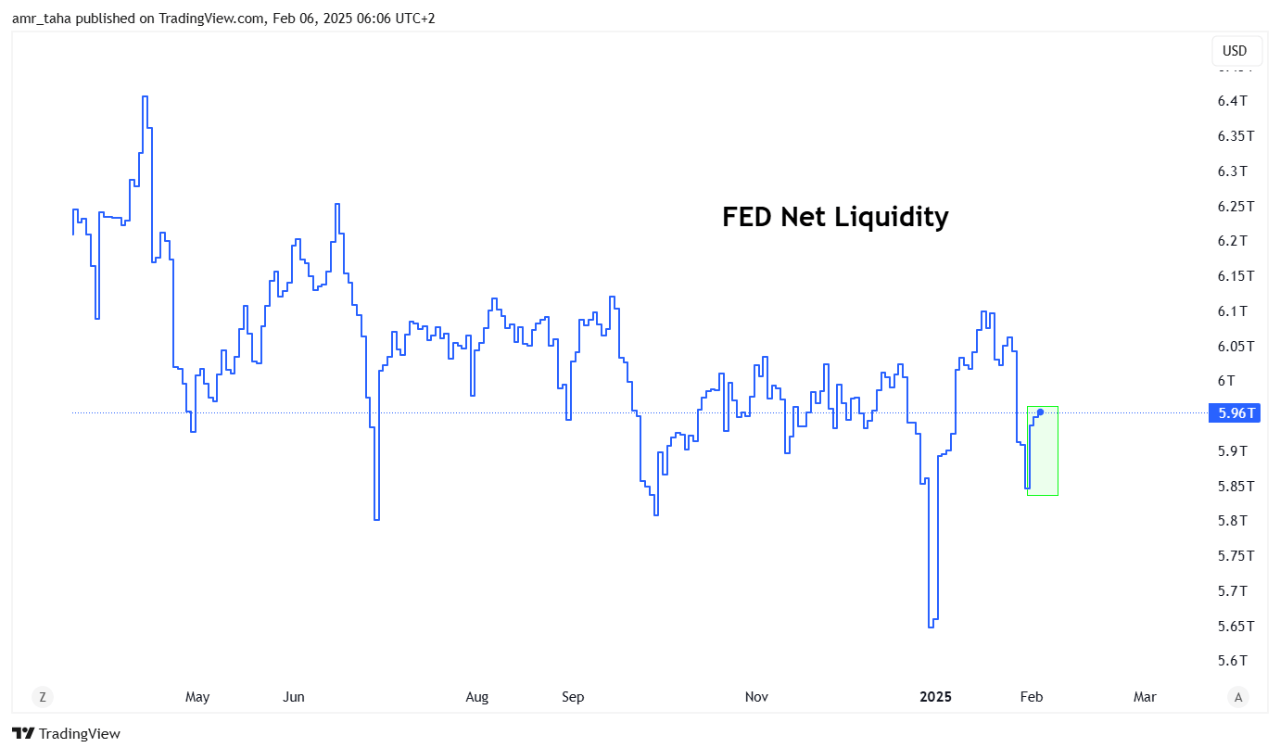

Most unusual Liquidity Stance And Key Metrics to Peer

Furthermore, Taha highlighted the significance of liquidity circumstances in the broader monetary machine. The usage of a metric identified as Fed Receive Liquidity—which subtracts the Treasury Long-established Chronicle (TGA) and Reverse Repo (RRP) from the Federal Reserve’s steadiness sheet—he pointed out that rising liquidity stages continuously occupy a bullish originate on possibility sources.

Only recently, the metric elevated from 5.85 trillion to 5.95 trillion, suggesting more capital is accessible to float into markets such as cryptocurrency. Traditionally, higher earn liquidity correlates with elevated asset costs, potentially benefiting Ethereum’s outlook.

Furthermore, one of many more immediate indicators to video display in step with Taha is Ethereum’s liquidation design. Taha seen that definite brand stages may perhaps perhaps perhaps force rapid positions into capitulation if ETH continues to climb.

This may perhaps perhaps perhaps reduction as a neighborhood off for additional upward creep if market circumstances remain favorable. Furthermore, the trajectory of earn liquidity will remain an very notable remark, as its direction continuously alerts the broader sentiment in direction of possibility sources.

Featured image created with DALL-E, Chart from TradingView