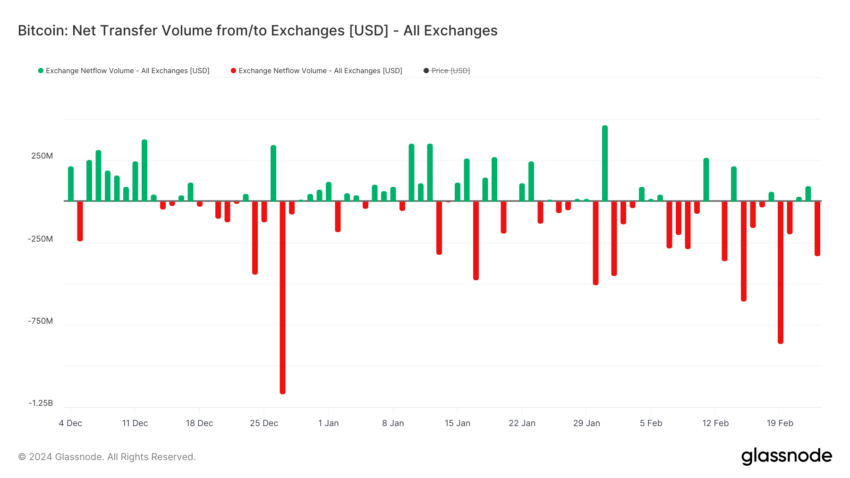

Bitcoin is experiencing a surge in outflows from centralized crypto exchanges, hitting its absolute most life like stage in eight months, indicating a fundamental shift in market dynamics.

Curiously, this construction coincides with a like a flash accumulation amongst crypto whales, pointing against a transformative section for Bitcoin’s valuation.

Bitcoin Outflows Hit $540 Million

On-chain recordsdata from IntoTheBlock, a neatly-known market intelligence platform, displays weekly accumulate outflows from centralized exchanges be pleased peaked. Roughly $540 million price of Bitcoin changed into as soon as withdrawn this week, marking the greatest accumulate outflow since June 2023.

Earlier within the week, CryptoQuant’s head of review, Julio Moreno, known the greatest hourly Bitcoin outflow this yr from Coinbase. Per him, 18,746 Bitcoin, estimated at $1 billion, were moved in two transactions for the duration of the identical block.

“The transactions be pleased the total patterns that might perhaps well well recommend: – The Bitcoin is going into custody (input consolidation, recent addresses being created with mammoth holdings of 866 or extra Bitcoin), or – It is factual an inner pockets reorganization. The first risk implies establishments hunting for Bitcoin,” Moreno explained.

The coast of BTC away from centralized exchanges is seen as a bullish imprint, indicating reduced availability for sale. Market observers be pleased suggested that the funds are being moved to custodial wallets in anticipation of a imprint surge, severely with Bitcoin halving factual two months away.

Certainly, the like a flash outflow has led to declining Bitcoin balances on fundamental exchanges love Binance and Coinbase. Glassnode recordsdata displays that crypto exchanges now withhold easiest 2.3 million BTC, the bottom stage since 2018.

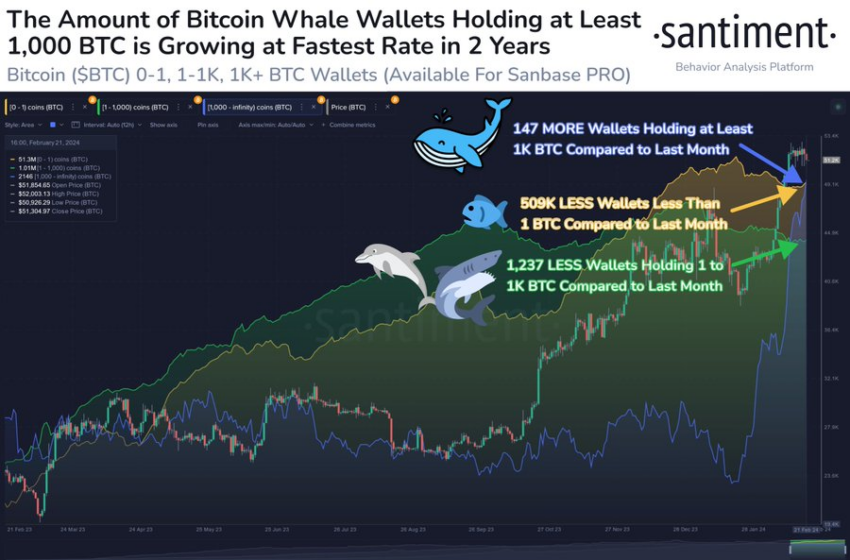

Crypto Whales Web BTC

Within the intervening time, crypto whales, conserving over 1,000 BTC, are experiencing fundamental accumulation. On-chain recordsdata from Santiment displays a 7.4% amplify in these addresses over the last month, with 147 recent wallets joining this class, marking the quickest development in two years.

CryptoQuant corroborates this, noting that the Bitcoin holdings of mammoth entities be pleased surged to the absolute most life like stage since July 2022, totaling 3.964 million Bitcoin, up from 3.694 million Bitcoin in December 2022.

This surge in crypto whale insist signals a stable vote of self belief in Bitcoin’s future trajectory. Historically, such fundamental accumulations customarily precede fundamental imprint actions, suggesting the functionality for one other bullish wave within the market.

“Spacious entities (1K to 10K Bitcoin) rising their holdings are correlated with greater prices as they denote rising Bitcoin quiz for funding capabilities,” CryptoQuant emphasized.

It is price noting the no longer too long ago launched space Bitcoin ETFs within the US are amongst the mammoth entities hunting for Bitcoin. These funds now withhold almost about 300,000 Bitcoin, rising as a fundamental quiz source for the tip asset.

Disclaimer

Per the Trust Mission guidelines, this imprint evaluation article is for informational capabilities easiest and might perhaps well well no longer be regarded as as monetary or funding advice. BeInCrypto is dedicated to correct, impartial reporting, however market prerequisites are topic to commerce without stare. Continuously habits your have review and search the advice of with a legitimate sooner than making any monetary decisions. Please advise that our Terms and Situations, Privateness Policy, and Disclaimers had been up so a ways.