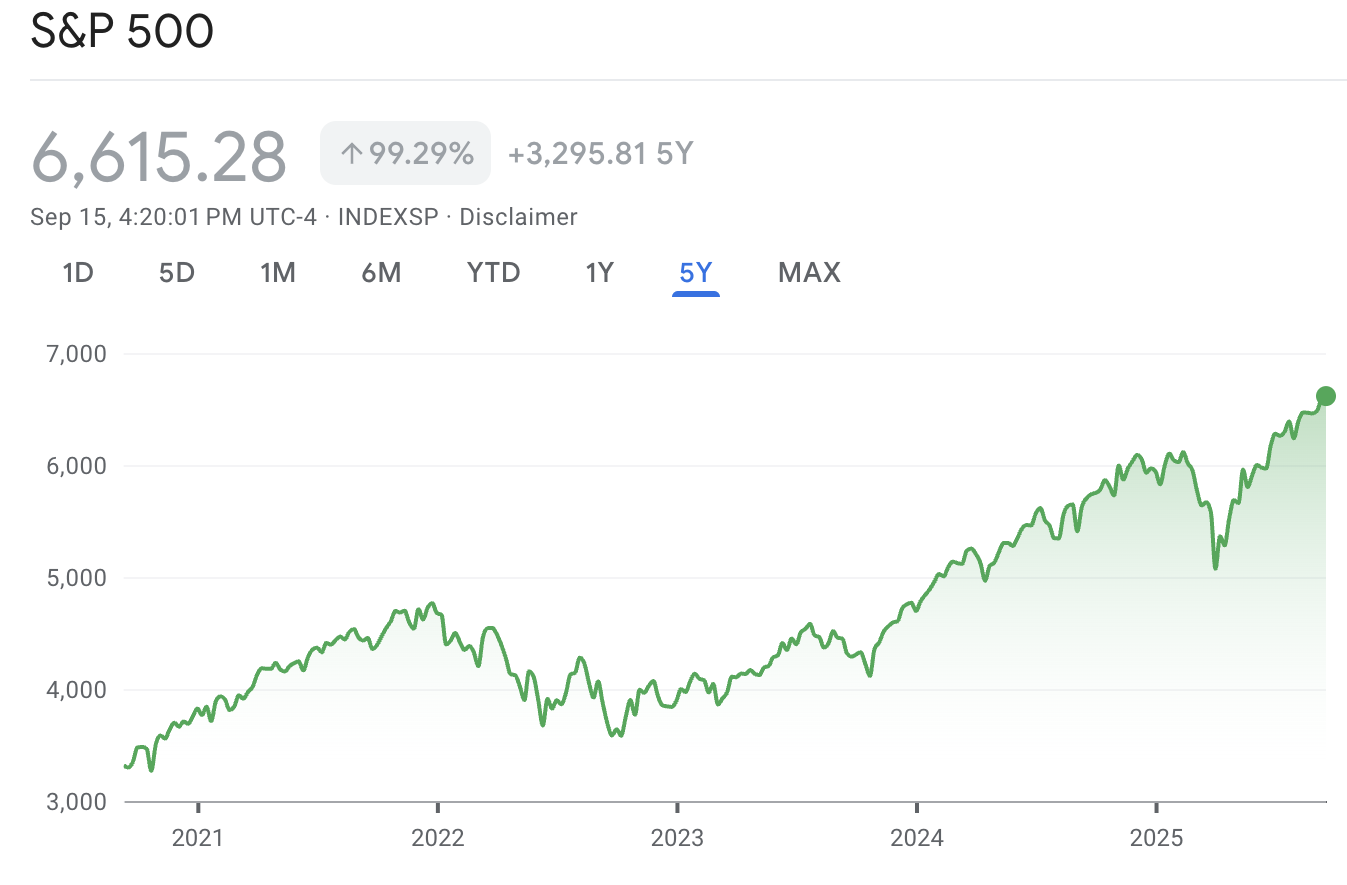

Gold and the S&P 500 both reached all-time highs this present day, whereas crypto market caps suffered a limited decline. This decoupling will be a bearish signal for future markets.

These two resources in most cases trust an inverse correlation, so their simultaneous features dispute a combine of warning and eagerness. If crypto will get left in the relieve of by both trends, it could perhaps perhaps perhaps presumably even be advanced to acquire momentum.

Gold and S&P 500 Put up Enormous Beneficial properties

Bitcoin is recurrently called the “digital gold,” and these asset courses can overlap in interesting solutions. Analysts lately predicted that the continuing gold rally could perhaps perhaps presumably push crypto to new heights, and essential companies are offering joint gold-crypto investment merchandise.

Nonetheless, the markets are taking a locate a little bit disconcerting this present day, as crypto is on the moment decoupling from both this commodity and the TradFi stock market. While gold and the S&P 500 both hit all-time highs, the crypto sector’s market cap actually decreased.

Namely, gold and the S&P 500 in overall trust an inverse correlation, so it’s rather relating in the occasion that they’re both gaining whereas crypto stays static. If these two courses are both going up, it seemingly indicators a combine of optimism and peril in TradFi markets.

Doable Risks to Crypto?

There’s one extremely considered culprit for these conflicting sentiments: impending cuts to US ardour charges. The next FOMC assembly is scheduled to happen very rapidly, and markets are practically clear that fee cuts will happen. This could be a blended blessing, offering investment opportunities alongside fears of buck inflation.

Therefore, this enviornment could perhaps perhaps presumably give treasured perception into crypto market dynamics. Analysts trust illustrious that the markets can also merely trust already priced fee cuts in. There used to be ongoing hypothesis as to whether or no longer or no longer crypto momentum will proceed, nonetheless these S&P 500 and gold movements could perhaps perhaps presumably expose that now we trust already hit a local top.

After all, why trust gold and crypto decoupled if Bitcoin is a store of fee? Conversely, why are Web3 market caps stagnating whereas TradFi is gaining esteem this? Are the markets exhausted from profit-taking? Would possibly well presumably regulatory concerns be an underrated supply of apprehension? It’s too rapidly to be clear.

Regardless of happens, it’s very uncommon that crypto is left in the relieve of whereas gold and the S&P 500 trust both been gaining. If this pattern continues, it could perhaps perhaps perhaps presumably signal a bearish flip for the industry.

The post S&P 500 and Gold Hit All-Time Highs: Why Hasn’t Crypto? regarded first on BeInCrypto.