Ethereum’s recent outperformance modified into as soon as accompanied by wide flows into ETH exchange-traded merchandise (ETPs), the asset manager VanEck reports.

In a recent market exchange, VanEck says that ETH ETPs pulled in $4 billion whereas Bitcoin noticed $600 million in outflows in the month of August, helping to push BTC dominance down from 65% to 57%.

“Ethereum ETP inflows persisted in August, constructing on the community’s file-breaking institutional adoption in July. Whereas dollar-denominated inflows declined from $5.5 billion in July to $4.0 billion in August, Ethereum unruffled sharply diverged from Bitcoin, whose ETP inflows fell from $6.1 billion in July to -$600 million in August.”

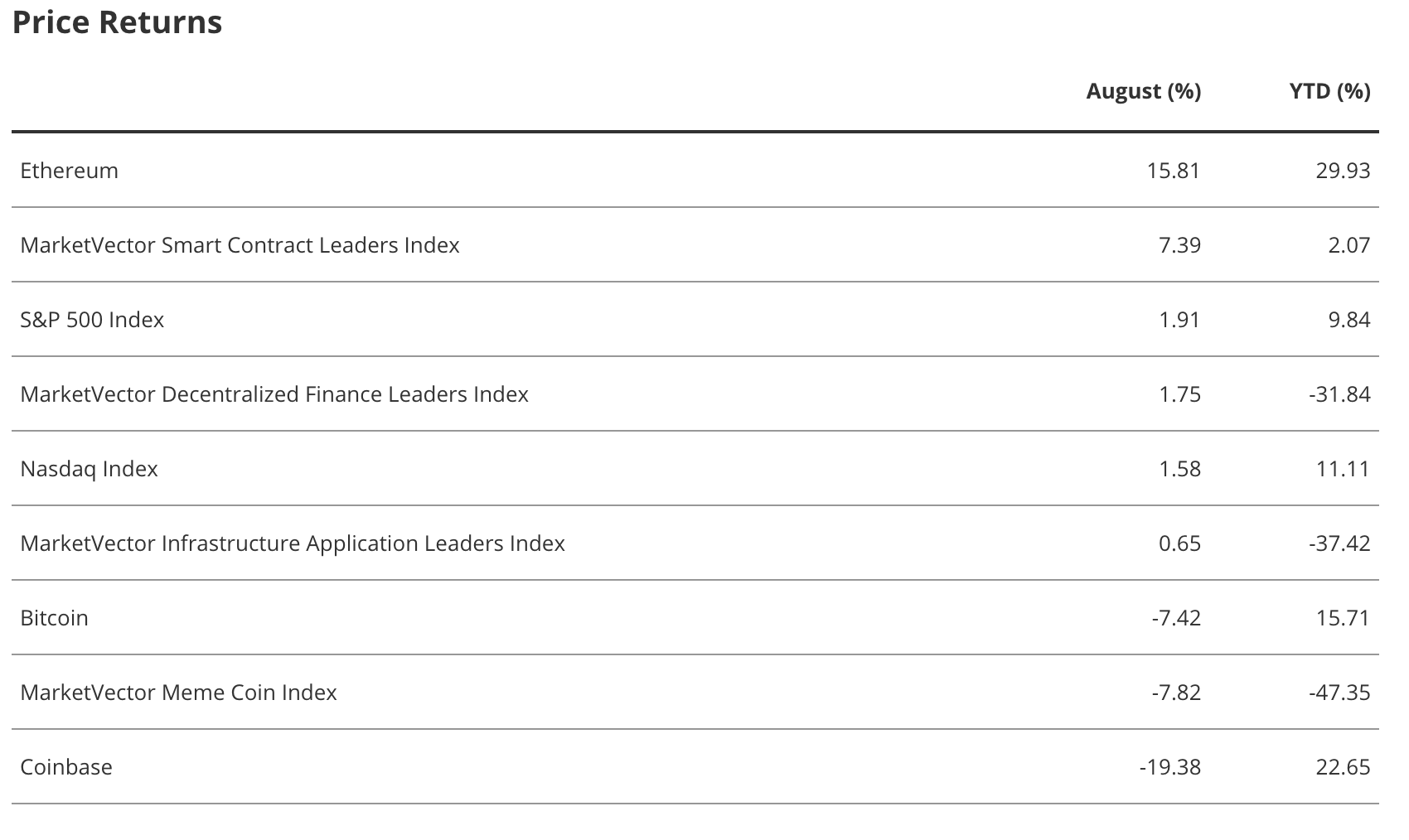

Because the inflows rolled in, Ethereum outperformed many other facets of the market, including the S&P 500, Nasdaq, shares of Coinbase and other asset courses.

Blockchain tracking firm Lookonchain reported that an unknown Bitcoin OG has been dumping its coins to alternate for ETH.

The whale’s most standard buy brought their whole ETH holdings to a staggering 886,371 ETH, which is valued at roughly $4.07 billion.

“This Bitcoin OG has equipped one other 2,000 BTC ($215 million) and equipped 48,942 ETH ($215 million) space [on Monday]. In whole, he has equipped 886,371 ETH ($4.07 billion).”

Per Lookonchain, the identical whale controlling a pair of wallets has been selling big amounts of BTC to stack Ethereum over the past few weeks.

Generated Image: Midjourney