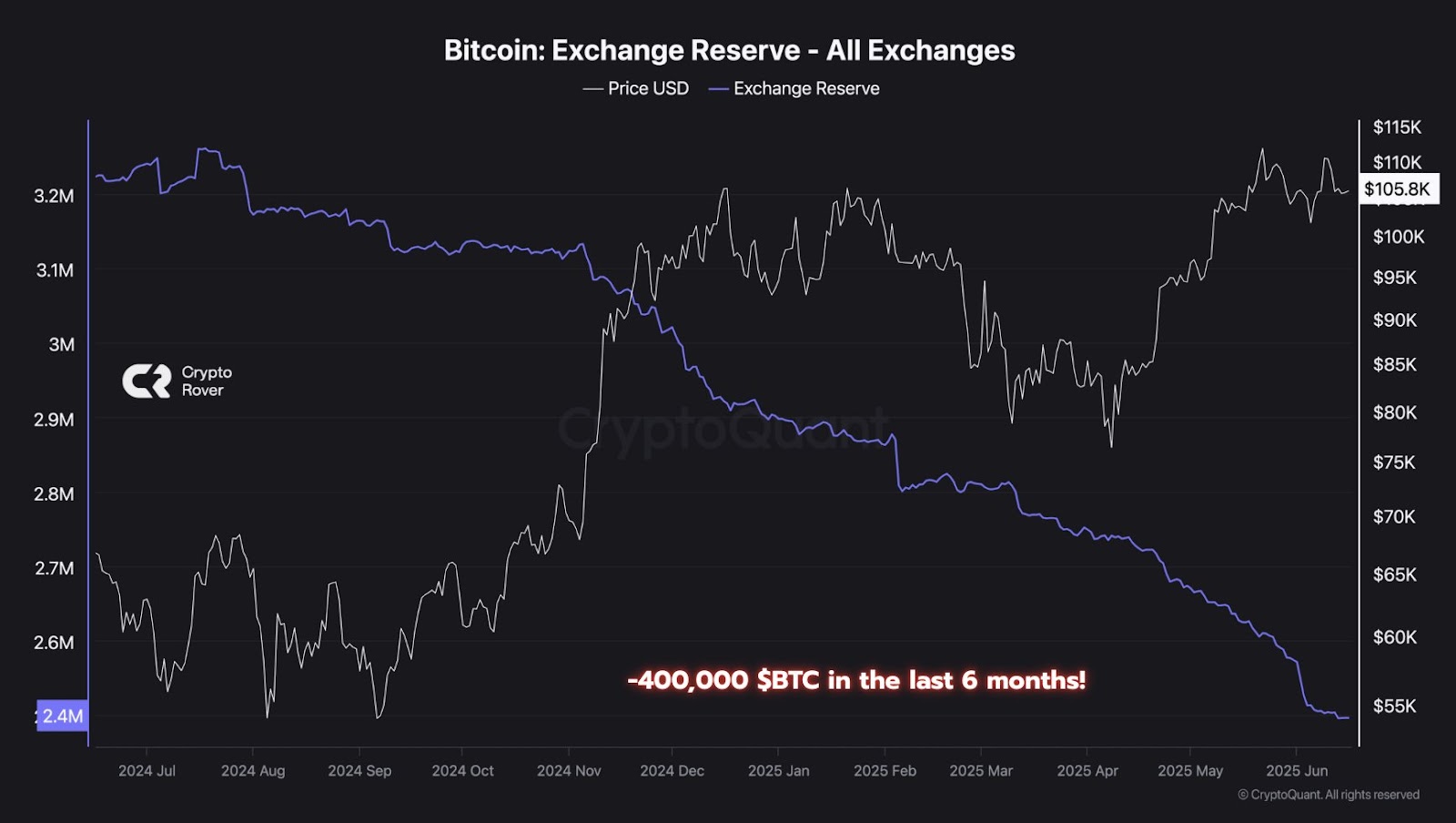

Over the last six months, Bitcoin trade reserves fell by 400,000 BTC, in step with on-chain data from CryptoQuant. A chart shared by Crypto Rover on June 16 presentations reserves dropped from spherical 2.8 million BTC in leisurely December 2024 to 2.4 million by mid-June 2025.

At some stage within the identical period, Bitcoin’s designate increased from below $70,000 to over $105,000. The chart presentations an inverse sample between designate and present on exchanges, with sources spirited off platforms whereas the associated rate climbed.

Lower Alternate Balances Might even Trigger Volatility

The data from CryptoQuant presentations that Bitcoin’s availability on exchanges reached its lowest point in over a one year. This pattern intensified during Might even and June 2025. On the identical time, the associated rate confirmed stronger beneficial properties, with the upward circulate accelerating past the $90,000 stamp.

This timing suggests that worthy investors could well even hold added to their positions as designate momentum returned. The persevered tumble in on hand present creates stipulations that would also amplify the impact of most contemporary quiz.

Analysts Verify Offer Shift to Non-public Wallets

Sjuul Follings of Merchants Union confirmed the info, noting that the decrease facets to reduced procuring and selling present.

CoinQuest echoed the pattern, declaring the sharp decline can even ranking a present crunch if quiz picks up. The post emphasised that worthy holders appear like gathering Bitcoin in periods of market hesitation.

The alternate in habits reduces the alternative of cash on hand for snappily procuring and selling. It furthermore shifts market dynamics, doubtlessly rising sensitivity to future designate swings.

Bitcoin’s Chart Kinds a Traditional “Bullish Pennant” Pattern

On the identical time, Bitcoin’s each day designate chart has fashioned a “bullish pennant.” on the 1-day chart published on TradingView. A bullish pennant appears when designate consolidates in a narrowing vary following a pointy upward pass, signaling doable continuation of the pattern as soon as designate breaks above the upper resistance.

On this case, Bitcoin trades at $107,648. If this sample confirms, the projected breakout target stands at approximately $127,342. This target displays an 18 percent expand from potentially the most contemporary designate, matching the peak of the previous rally previous to consolidation.

The candlestick structure presentations greater lows and decrease highs forming a symmetrical triangle. This shape follows a clear upward flagpole that started in leisurely April and peaked in early Might even. The sample sits above the 50-day Exponential Transferring Common (EMA), at this time positioned at $103,000. Tag keeping above this level supports the bullish case.

Quantity has declined during the consolidation, which is identical previous for a pennant structure. A breakout above the upper purple trendline, ideally supported by increased procuring and selling volume, would confirm the bullish continuation.

If confirmed, Bitcoin can even resume its previous uptrend and attain the projected target. However, the breakout wants stable momentum to retain the pass past rapid resistance shut to $110,000.

Disclaimer: The details presented listed here is for informational and tutorial positive aspects handiest. The article does no longer represent financial advice or advice of any form. Coin Edition is now to no longer blame for any losses incurred due to utilization of deliver material, products, or products and providers talked about. Readers are knowledgeable to whisper warning previous to taking any action related to the firm.