The price of Dogecoin (DOGE) has declined a tiny bit by 0.47% over the day prior to this. Amid this decline, DOGE has shaped key resistance at the 32.68 billion coin stage, based on IntoTheBlock.

What 32.68 billion resistance technique for DOGE

For DOGE, breaching this resistance is extraordinarily crucial, because it could decide future mark lag. A upward push in total quantity above 32.68 billion could possibly propel mark features for DOGE. If the coin surmounts present selling stress and breaches this stage, its mark could possibly soar to $0.115 in the very long time-frame.

On the opposite, a drop below this stage could possibly ship the meme coin into further downtrends. This blueprint the present drop in Dogecoin’s mark does no longer preserve water until the meme coin crosses this key resistance stage.

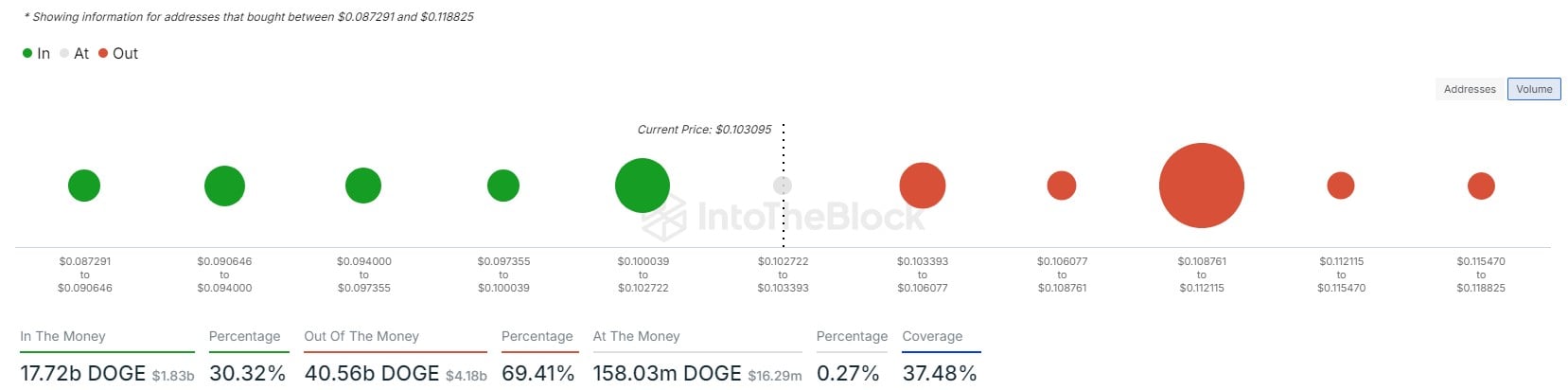

Within the period in-between, the “in/out of the cash” indicator, a tool former to evaluate the profitability of addresses protecting DOGE, finds that 69.41% of coin holders are “out of the cash.” This means an amplify in selling stress, as seen in Dogecoin’s present efficiency.

Nonetheless, 30.32% of addresses are presently protecting DOGE in income. This share represents holders that will most seemingly be much less inclined to sell, providing a stable enhance stage for the meme coin. Also, Dogecoin’s 24-hour procuring and selling quantity has declined by 12%, indicating that a doable reversal could be on the horizon.

Faith in Dogecoin’s recovery

Actions from astronomical coin holders, most frequently called “whales,” enjoy furthermore contributed to Dogecoin’s present resistance and enhance ranges. On the total, activities from astronomical holders can sway the price bigger than smaller retail investors.

As previously reported by U.This day, astronomical holders currently eradicated $30 million price of DOGE from exchanges. This is in a position to point out that these astronomical investors are making ready to preserve DOGE for a protracted duration in the hope of future mark development. Their activities could possibly reason steadiness in Dogecoin’s mark attributable to much less selling stress introduced on by lower alternate holdings.