The crypto market will watch $2.639 billion in Bitcoin (BTC) and Ethereum (ETH) alternatives contracts expire this day. This huge expiration would possibly perhaps perhaps per chance affect non eternal mark action, especially given the volatility viewed in each resources all over the final few days.

With Bitcoin alternatives valued at $1.9 billion and Ethereum at $712 million, will crypto markets seek for volatility lengthen or watch a gradual kickoff to 2025? The following is what these alternatives expiration capacity for BTC and ETH prices.

First Crypto Ideas Expiry of 2025: Over $2.6 Ideas Expire

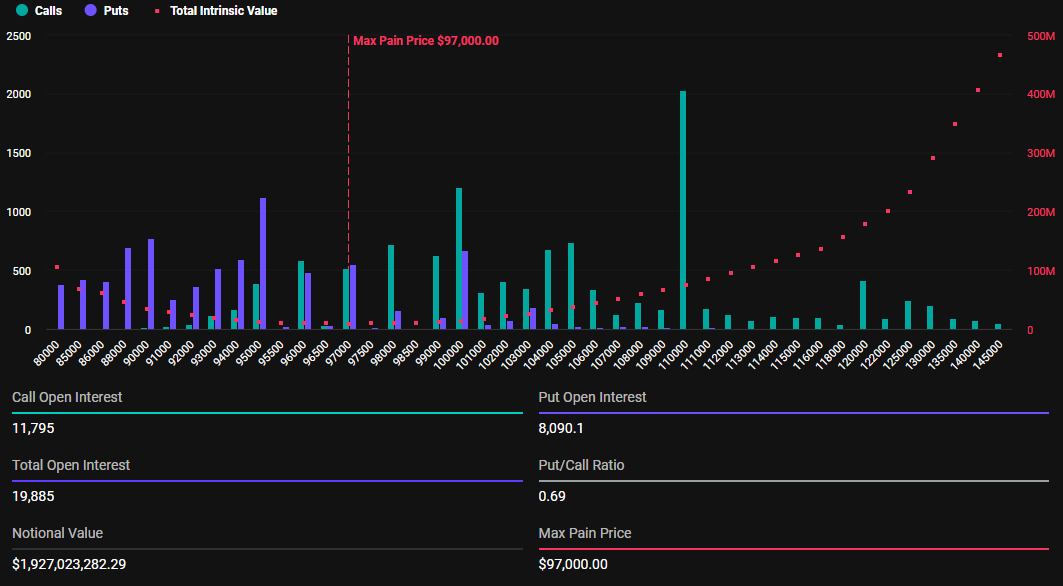

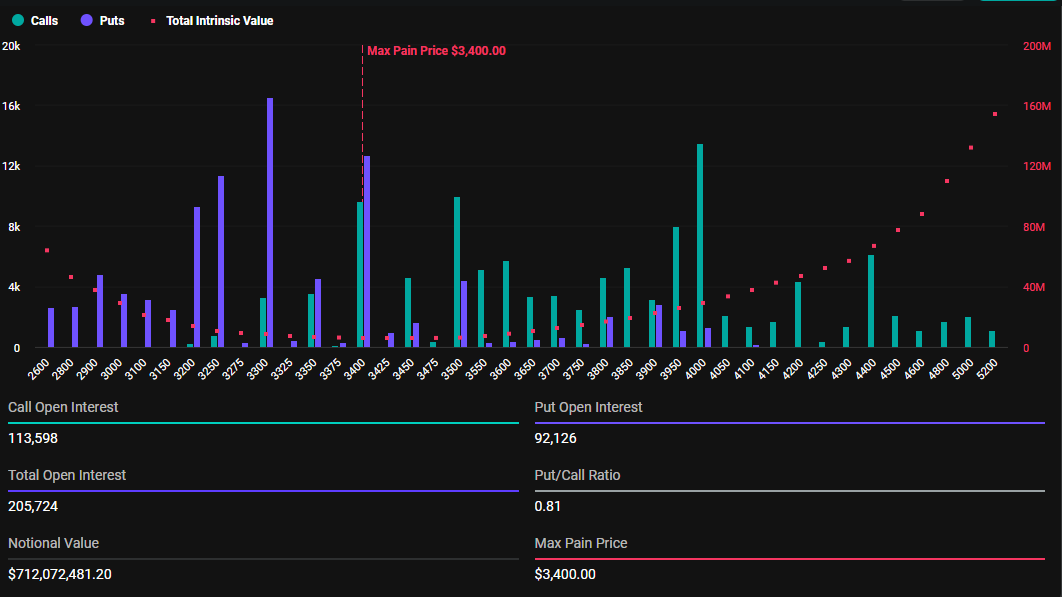

Knowledge on Deribit shows this day’s Bitcoin alternatives expiration involves 19,885 contracts, when in contrast with 88,537 contracts final week. Equally, Ethereum’s expiring alternatives complete 205,724 contracts, down from 796,021 contracts the previous week. The disparity stems from final week’s contracts, which marked the cease-of-year alternatives expiry.

For Bitcoin, the expiring alternatives dangle a most wretchedness point (strike mark) of $97,000 and a spot-to-name ratio of 0.69. This signifies a on the total bullish sentiment no topic the pioneer crypto’s ongoing fight to reclaim the $100,000 milestone.

In contrast, the Ethereum contracts expiring this day dangle a most wretchedness mark of $3,400 and a spot-to-name ratio of 0.81, reflecting a equal market outlook. When the place-to-name ratio is under 1, extra merchants are having a wager on mark increases.

In alternatives trading, the strike mark is a well-known metric that continuously guides market behavior. It represents the mark stage at which most alternatives expire nugatory, inflicting most monetary “wretchedness” on merchants as alternatives expire nugatory.

Traders and merchants should always brace for volatility, as alternatives expirations continuously trigger non eternal mark fluctuations, which make market uncertainty. Namely, the asset’s mark tends to gravitate toward the mark to optimize income for alternatives sellers, who, in most conditions, are sizable monetary institutions of clear money.

Per BeInCrypto data, BTC was as soon as trading for $96,912 as of this writing, whereas ETH was as soon as exchanging palms for $3,465. Gravitating toward their respective strike prices would, attributable to this reality, signify a modest mark make bigger for Bitcoin and a dinky tumble in Ethereum’s mark, hence doable volatility.

“Volatility ranges dangle retained a fixed stage and shape within the course of the put up-Christmas length. December’s cease-of-year expiration of a vital percentage of the market’s starting up passion in alternatives did now not consequence within the fireworks that some expected. As an different, ETH volatility trades extra than 5 facets decrease while BTC shows the same, a shrimp steeper shape that it has since Christmas day,” Deribit shared.

Even within the face of doable volatility, on the opposite hand, markets assuredly stabilize soon after as merchants adapt to the fresh mark ambiance. With this day’s excessive-quantity expiration, merchants and merchants can inquire of a equal final consequence, doubtlessly influencing non eternal market traits.