2024 is in general a “decent year for staunch-haven resources”, equivalent to Bitcoin, gold, and silver, in accordance to Jag Kooner, Head of Derivatives at Bitfinex. In a commentary despatched to Crypto Briefing, Kooner shares his belief that the power inflation phases, final above the comfort zones of central banks around the enviornment, are anticipated to kill in a extended length of better passion charges.

This might kill in a delay in easing of monetary policies in developed markets, that could also lead to some disappointment among traders. Furthermore, Kooner aspects out that stock markets could also face some challenges over the next months.

“Components equivalent to modest earnings development and diverse geopolitical risks are expected to exert downward stress on stock markets. A little of research suggests modest earnings development for the S&P 500, in the vary of 2–3% and a aim of 4,200 for the index, with a downside bias. This aligns with our peek and we factor in will kill in extra put a question to for commodities and Bitcoin.”

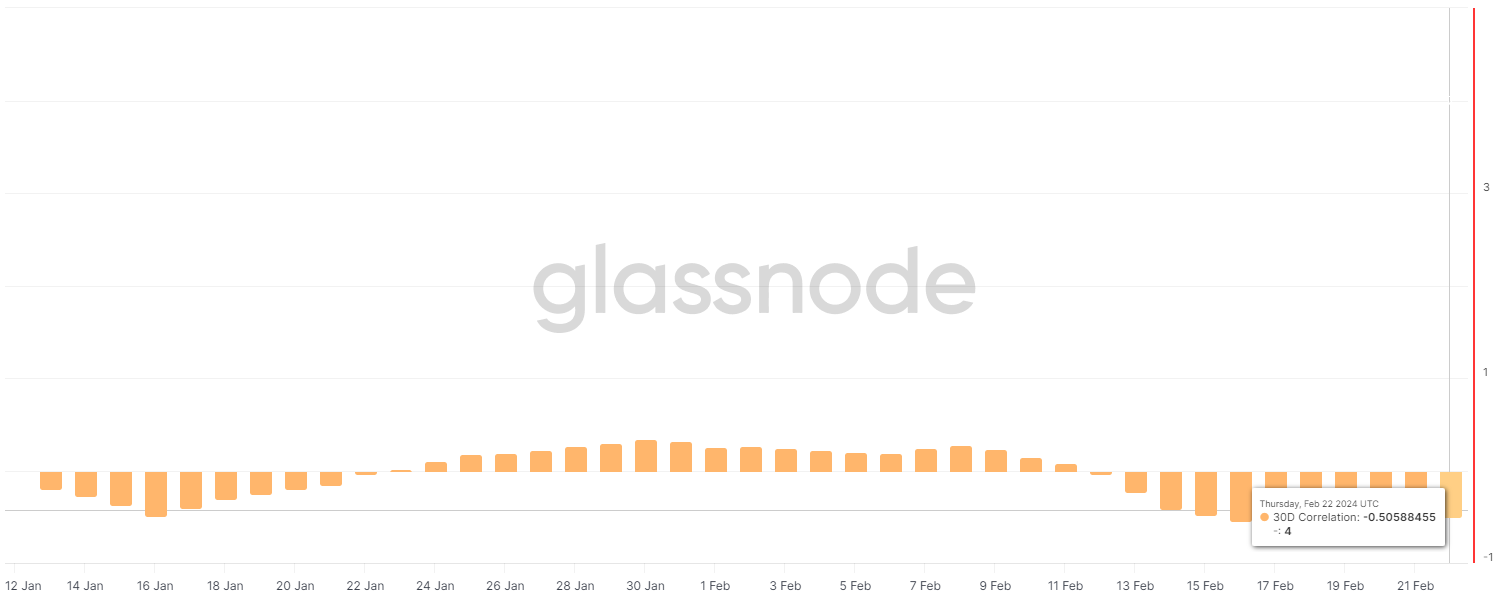

Nonetheless, the correlation between Bitcoin and gold has been antagonistic in the final 30 days, in accordance to on-chain files platform Glassnode. On Feb. 22, the pair shared a antagonistic correlation of 0.5, where 1 is fully correlated and -1 is the absence of any correlation.

If Kooner’s prediction comes staunch, the info corroborating it might also start exhibiting over the next weeks.