The cryptocurrency market has no longer too prolonged ago witnessed the 2024 Bitcoin halving, an match that severely reduces the reward for mining BTC by half, aimed at limiting its original offer.

This pivotal match, the fourth since Bitcoin’s creation, has stimulated huge discussions about its implications for miners, investors, and the broader market landscape.

Bitcoin Miners Upgrade

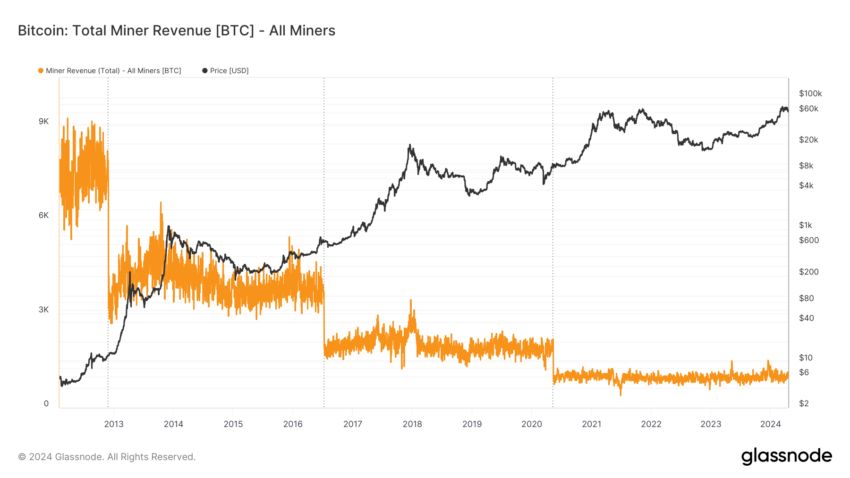

As the block reward halved from 6.25 BTC to three.12 BTC, miners before every part face fundamental challenges. Omar Lopez, Founding father of Cripto It Club, shared with BeInCrypto that a allotment of the miners will seemingly be compelled to shut down their operations as persevering with becomes economically unfeasible. Some will even procure themselves working at a loss.

This order embodies a assemble of sport theory, in accordance with Lopez. On the delivery place, if 1,000 miners are profitably mining 6.25 BTC, the profitability equation shifts dramatically put up-halving when the reward drops to three.12 BTC, unfold amongst the same preference of miners. This alternate forces those miners who can’t preserve losses to cease their operations.

Sooner or later, this attrition might in the discount of the quantity to, converse, 600 miners. For these last miners, the reduced opponents for the 3.12 BTC might restore profitability, stabilizing the mining landscape.

“Miners discover the worth of Bitcoin, no longer the varied approach round. If the worth of Bitcoin is low and it’s no longer winning to mine, loads of miners will flip off their machines. Until it becomes winning for those last to compete for the 3.12 BTC. Sport theory in all its glory,” Lopez explained.

For this motive, some Bitcoin miners are more and more investing in cutting-edge work applied sciences. Hao Yang, Head of Monetary Merchandise at Bybit, highlights the strategic shift in direction of more sophisticated mining alternate options.

Many miners upgrade their equipment to newer objects that bring better mining vitality with reduced energy consumption. This approach is typically feasible for the more professionalized Bitcoin miners who hold the well-known capital.

By doing so, they’re succesful of toughen their profitability, severely throughout the no longer easy initial days following the Bitcoin halving.

“Miners are focusing on energy effectivity and diversification by investing in subsequent-generation equipment esteem three nanometer mining rigs, which might perchance amplify hash rate to three.4 exahash per second, enhancing skill with out a proportional amplify in energy consumption,” Yang told BeInCrypto.

This upgrade no longer handiest aids in sustaining operations but also contributes to overall effectivity in the mining route of. Because of the this truth, it ensures that miners stay aggressive put up-halving.

Be taught more: Free Cloud Mining Suppliers to Mine Bitcoin in 2024

Extra emphasizing sustainability, miners are adopting energy-ambiance friendly applied sciences and integrating their operations into broader energy techniques. This attain entails exploring renewable energy sources much like photo voltaic and wind, and even harvesting energy from raze products.

These are changing into long-established alternate options to in the discount of the environmental impression of mining operations.

Rampant Quiz for BTC

Furthermore, Yang notes fundamental adjustments in the Bitcoin market’s construction, severely with the introduction of Bitcoin commerce-traded funds (ETFs). These be pleased performed basically the major role in merging Bitcoin with historic monetary markets.

“The ETFs had been a important approach that historic investors can engage with Bitcoin as a portfolio diversifier in a approach that is regulated and acquainted. In this sense, these monetary devices be pleased proved that Bitcoin is right here to preserve, that it’s no longer going to zero, that it’ll and can peaceable play a section in our future monetary system,” Yang added.

This integration has no longer handiest stabilized label volatility and demonstrated Bitcoin’s enduring presence in the monetary ecosystem. It has also opened the floodgates to fulfill the increasing request of from institutional investors. Collectively, region Bitcoin ETFs now withhold over 837,700 BTC, worth $fifty three.61 billion.

As a outcome, this has severely enhanced market liquidity, in accordance with Mauricio Di Bartolomeo, Co-Founding father of Ledn.

“Right here is the predominant halving the place region Bitcoin ETFs are stay available in the market, unlocking an avalanche of institutional request of. To this level, it looks esteem the necessities are region for this halving to be pleased a same impression on label as old ones be pleased,” Di Bartolomeo told BeInCrypto.

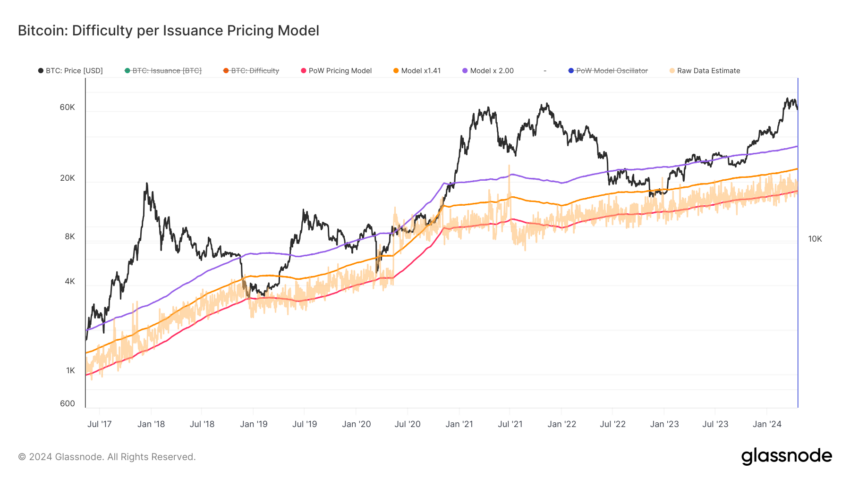

Even supposing instant label surges put up-halving are no longer always evident, the general consensus is that the halving will positively impression Bitcoin’s worth in the prolonged trot esteem it has accomplished historically.

Right via the initial Bitcoin halving on November 28, 2012, the worth stood at $12 and later soared to a excessive of $1,242, representing an excellent amplify of 9,937%. The second halving, which came about on July 16, 2016, started with Bitcoin priced at $664, and it finally climbed to $19,804, reflecting a 2,903% upward push. The most up-to-date halving, dated Could perchance 11, 2020, saw Bitcoin at $8,571, with its peak later reaching $68,997, an amplify of 705%.

“Historically, label bound has been reasonably muted round the halving itself but there turn into once a fundamental label trot-up 9-twelve months afterwards. This perceived to be driven by Bitcoin miners incomes less Bitcoin to sell in the marketplace, relative to the request of for Bitcoin. As such, the halving has been a ‘buy after the news’ match,” Andy Fajar Handika, CEO at Loka Mining, told BeInCrypto.

Be taught more: What Took region on the Final Bitcoin Halving? Predictions for 2024

As Bitcoin evolves put up-halving, the introduction of up-to-the-minute, more energy-ambiance friendly mining applied sciences and techniques will seemingly continue to shape the industry. These advancements are well-known for affirming the steadiness and prolonged-term sustainability of the Bitcoin network, reinforcing its region as a fundamental order of the prolonged trot monetary system.

With each halving, Bitcoin takes a step nearer to its eventual offer limit, underscoring its queer financial mannequin and its doable to continue influencing the international monetary system.