Key Notes

- The whale generated $33.12M in total profits historically and at this time holds $6.36M unrealized develop on the quick entered at $111,499.

- This day’s crypto market recorded $343.89M in liquidations, with quick positions accounting for $256.95M versus $86.94M in longs.

- Bullish technical indicators and institutional accumulation job are setting up upward tag stress in the direction of the liquidation threshold.

A Hyperliquid trader faces doable liquidation of a 1.23K Bitcoin quick residing valued at $131 million if the cryptocurrency reaches $111,770. The pockets take care of 0x5d2f..b7 opened the residing the use of 20x unhealthy leverage on the decentralized perpetual futures alternate.

Bitcoin BTC $105 537 24h volatility: 1.7% Market cap: $2.11 T Vol. 24h: $73.06 B traded at $106,443 as of Nov. 10, 2025, in preserving with TradingView data. The sizzling tag sits $5,327 below the liquidation trigger. Analytics platform CoinGlass flagged the whale’s exposure in a social media put up on Nov. 10.

#Hyperliquid Liquidation Blueprint

If Bitcoin breaks above $111,770, a tidy whale’s quick residing worth 1.23K $BTC shall be liquidated.🧐https://t.co/RO2fCIDLi1 pic.twitter.com/UUebjOsBG3

— CoinGlass (@coinglass_com) November 10, 2025

The trader holds a $6.36 million unrealized earnings, representing a 4.86% develop from the practical entry tag of $111,499.30. The whale’s total memoir price on Hyperliquid stands at $8.54 million.

Bitcoin Rally Drives $343M in Market Liquidations

The crypto market recorded $343.89 million in compelled residing closures over 24 hours as Bitcoin reclaimed $106,000 on Nov.10. Fast positions accounted for $256.95 million, representing 74.7% of the total. Long positions made up the final $86.94 million.

The heavy concentration of quick liquidations indicates sustained upward tag stress. As Bitcoin rallies, quick traders face compelled buying to shut positions. This effect a query to of could per chance push costs in the direction of the $111,770 threshold, where computerized liquidation would trigger.

Whale’s Winning Trading Historical previous

The pockets has generated $33.12 million in total realized profits on Hyperliquid. Transaction data converse the trader opened the unique quick through more than one entries initiating in September 2025. Well-known job involves two critical auto-deleveraging events on Oct. 10, 2025, sharp positions worth $28.38 million and $18.87 million.

The whale’s approach contrasts with assorted Hyperliquid whale trading job where yet every other trader opened a $64.7 million residing in leveraged long positions on Nov. 5, betting on tag increases.

What Would per chance Push Bitcoin to the Scheme off

Photo Credit: TradingView

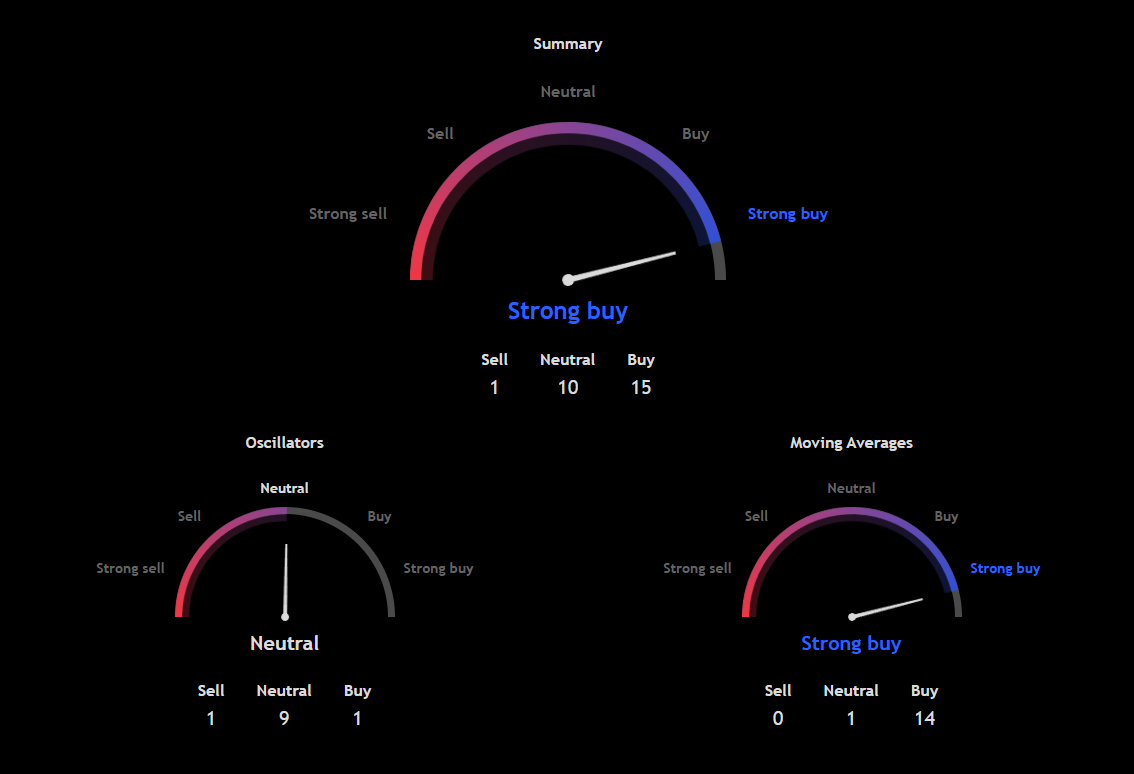

Fast-term technical prognosis presentations Bitcoin has bullish momentum with 15 purchase indicators versus one promote signal. The Relative Strength Index registered 66, indicating neutral-to-bullish sentiment without overbought prerequisites.

Most up-to-date institutional Bitcoin buying job from entities admire Approach creates extra effect a query to of stress. Approach ready for accumulation after a €620 million elevate. Blended with heavy quick liquidations forcing buying, these components could per chance force Bitcoin to $111,770, where the whale’s residing would robotically shut.

Disclaimer: Coinspeaker is devoted to offering self ample and transparent reporting. This article targets to verbalize comely and properly timed data nonetheless need to now not be taken as financial or investment advice. Since market prerequisites can alternate swiftly, we merit you to ascertain data on your possess and consult with a talented ahead of setting up any choices in preserving with this philosophize material.