Ethereum (ETH) has witnessed a decline in interrogate over the final few months. On account of this slowdown in blockchain exercise, the Ether burn price has been lowered. This has increased the coin’s circulating provide and connect downward stress on its heed.

In a brand original document, digital asset overview company 10X Research highlights what may well perhaps be guilty for this.

Ethereum Begins to Lose Its Shine

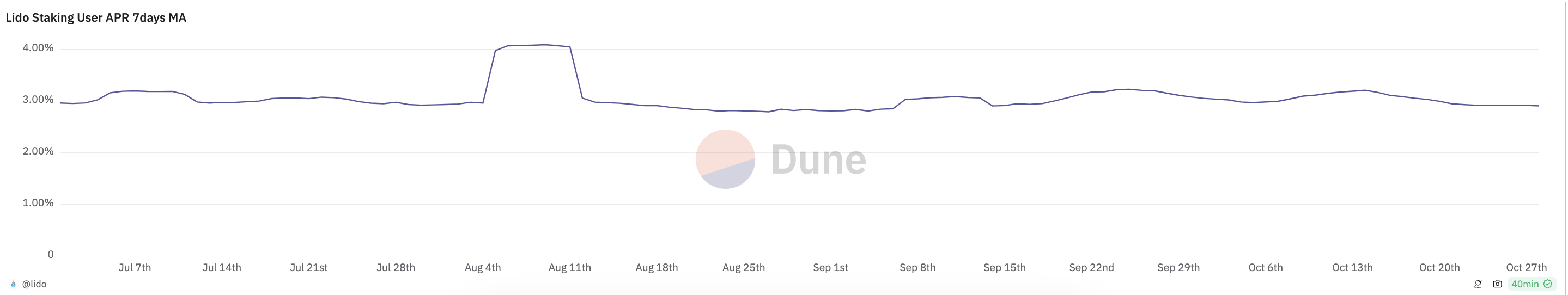

In its most up-to-date document, 10X Research highlighted falling staking yields on the Ethereum community as a predominant problem contributing to the decline in blockchain exercise. As an instance, the Annual Share Fee (APR) for customers on Lido, Ethereum’s most attention-grabbing staking provider, has continuously dropped since August, now at 2.90%.

Read more: How to Put money into Ethereum ETFs?

The digital asset overview company highlighted that this pattern stems from the like a flash rise of low-price meme tokens on chains like Solana. In consequence, many ETH holders now watch staking essentially as a modest earnings offer reasonably than a catalyst for broader ecosystem engagement.

Moreover, the existence of excessive-yield dilapidated finance alternatives has also made staking ETH on the Ethereum community less attention-grabbing, additional reducing the interrogate for the community.

“With TradFi curiosity rates (fair like 2-one year Treasury yields at 4.1%) very much outpacing ETH staking yields at 2.9%, Ethereum holders face a slack bleed. The dearth of interrogate for ETH drives down its collateral price in USD, Bitcoin, and assorted preferred benchmarks and diminishes total charm,” 10X Research explained.

10X Research accepted that Ethereum noticed a snappy rise in exercise following the September FOMC assembly, but momentum has since waned. If Donald Trump wins the upcoming election, excessive US Treasury yields may well perhaps well abet outpacing ETH staking yields, striking persevered stress on ETH prices.

“There is a chance that ETH fades into the background, as we’ve seen with assorted excessive flyers at some level of the old 2016/2017 and 2020/2021 cycles. Contrary to Bitcoin, Ethereum has now not made a brand original excessive to this level in this cycle; as a change, it will want to rally by +87% to eclipse the 2021 excessive,” the overview company added.

ETH Label Prediction: The Nays Could perhaps perhaps Have It

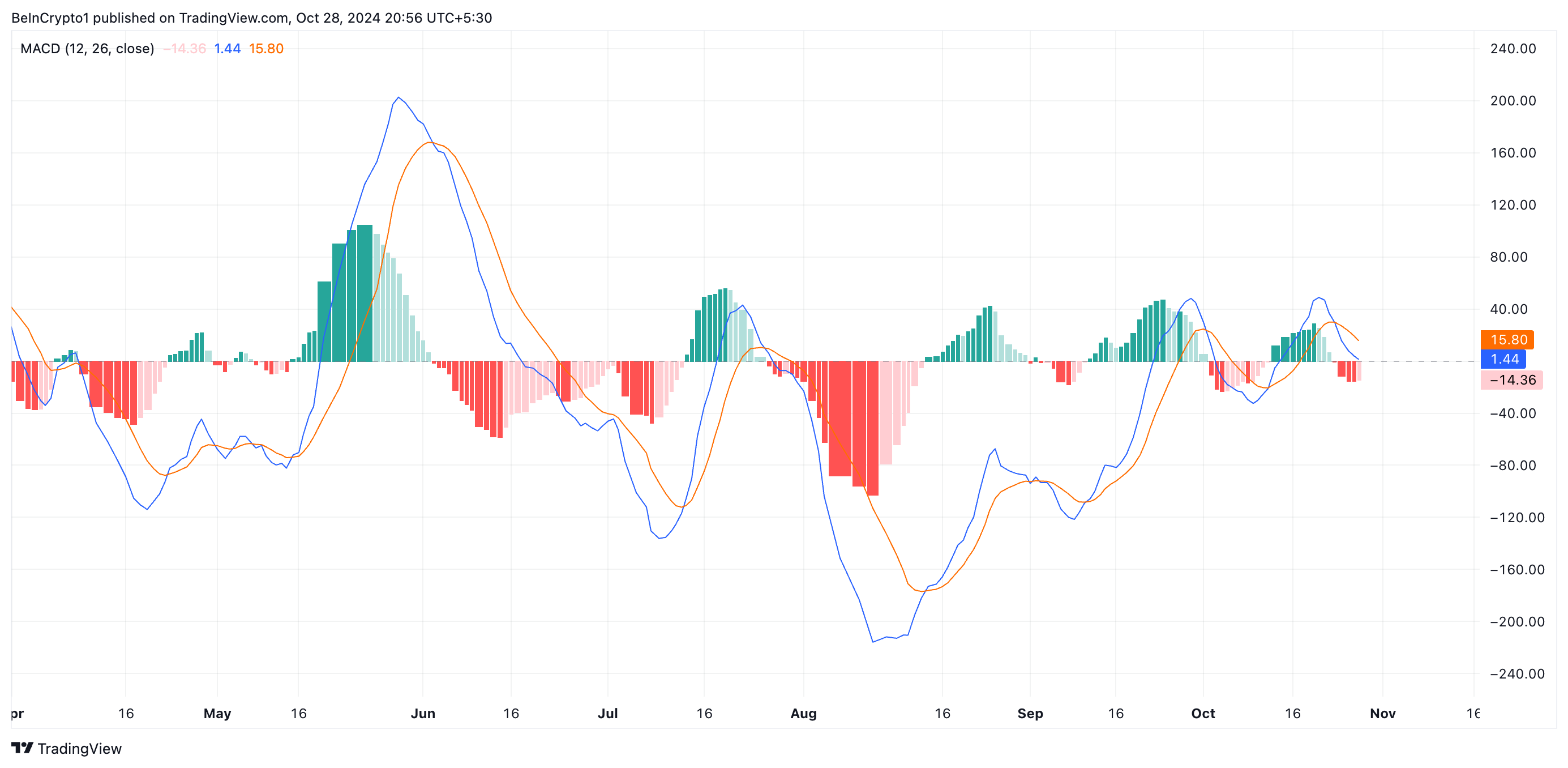

As of this writing, Ethereum is trading at $2,512, factual unnerved of the resistance formed at $2582. BeInCrypto’s review of the ETH/USD one-day chart review confirms the bearish bias plaguing the leading altcoin.

As an instance, readings from its transferring moderate convergence/divergence (MACD) ascertain the slowed interrogate for ETH. The coin’s MACD line (blue) is below the label line (orange) and is poised to inferior below the zero line.

MACD measures an asset’s heed traits and momentum and identifies its capability aquire or sell indicators. When attach up this form, it signifies a bearish pattern within the market, suggesting that total momentum is opposed and the asset is in a downtrend.

If this pattern continues, Ethereum’s heed will likely tumble toward make stronger at $2,425. If the bulls fail to defend this level, Ethereum may well perhaps well plummet additional to $2,116.

Read more: Ethereum (ETH) Label Prediction 2024/2025/2030

Conversely, a shift to obvious market momentum may well perhaps well push Ethereum’s heed above its resistance at $2,582, with a target of $2,871 — a excessive it final reached in August.