Uniswap, an Ethereum-basically based decentralized alternate (DEX), stands at the brink of a transformative shift within the decentralized finance (DeFi) sector.

A brand original governance proposal seeks to redirect protocol costs to UNI token holders, marking a important scamper in democratizing the network.

Uniswap Community Supports Unique Proposal

Snapshot voting signifies overwhelming community backing for the associated rate reward proposal, slated to terminate by March 7.

The proposal entails upgrading the UniswapV3Factory contract and empowering seamless and programmatic sequence of protocol rate income. This strategic transfer objectives to toughen the governance framework, endowing UNI token holders with heightened affect over decision-making processes.

“Particularly, we imply to upgrade the protocol such that its rate mechanism rewards UNI token holders which like delegated and staked their tokens,” Erin Koen, Governance Lead at Uniswap Foundation, outlined.

No doubt, the revamped governance structure of Uniswap objectives to incentivize active engagement amongst UNI token holders, thereby bolstering the protocol’s sustainability and fostering its expansion.

Learn more: How To Purchase Uniswap (UNI) and All the pieces You Need To Know

Today, unanimous enhance prevails amongst voters, with over 10 million UNI tokens pledged to the upgrade.

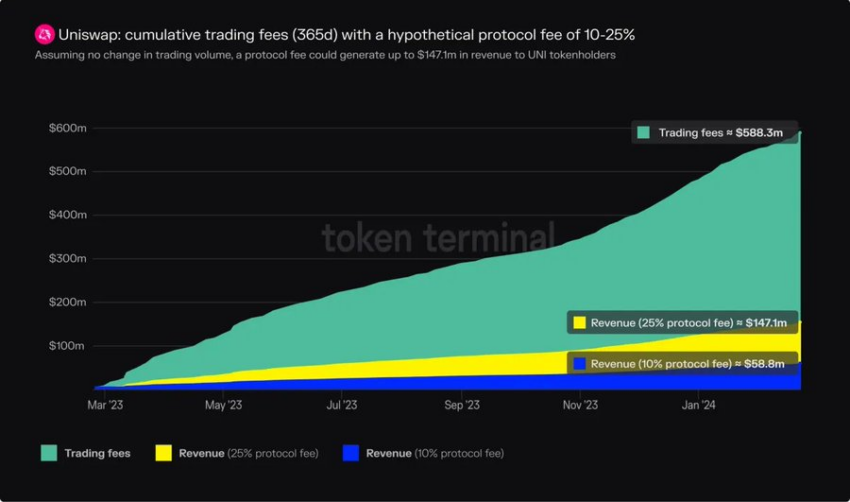

Blockchain analytics firm Token Terminal highlighted the massive beneficial properties UNI holders stand to reap from the proposal. Prognosis unearths that, had the associated rate switch been activated, UNI holders would maybe like collected as great as $58 million from the $588.3 million in trading costs generated by facilitating $437.7 billion in trading quantity over the past year.

“Assuming that a 10% protocol rate will get implemented, Uniswap would turn into the Ninth most income-generating protocol in crypto, rating between Optimism Mainnet and Avalanche,” Token Terminal explained.

However, due to the the dormant rate switch, Uniswap has but to cherish income from these costs, leaving necessary untapped ability.

UNI Designate Prediction: Additional Upside Attainable

UNI’s label has surged in fresh weeks, gaining huge momentum following the introduction of the original governance proposal. Pricing recordsdata from BeInCrypto reveals Uniswap’s market label has soared by 100% over the past month.

It peaked at over $13 from its outdated degree below $5, and it for the time being stands at $12.43, reflecting a shrimp correction.

Learn more: Uniswap (UNI) Designate Prediction 2023 / 2025 / 2030

Market analysts attribute this outstanding enhance to the existing optimism surrounding the associated rate reward proposal. Significantly, one analyst emphasized the pivotal position that the proposed style would maybe play in shaping the token’s trajectory.

“Pretty dapper weekly chart. As long as we attend ~$9.8, I would maybe be taking a scrutinize for a break of $13 in some unspecified time in the future within the long trail. It will likely attain the total diagram down to how the proposal surrounding the associated rate fragment will fade,” analyst DaanCrypto opined .

Disclaimer

Your total recordsdata contained on our online page is published in merely faith and for overall recordsdata applications only. Any action the reader takes upon the tips chanced on on our online page is precisely at their like probability.