Cryptocurrency-connected crime is evolving in 2024, with hackers an increasing selection of targeting centralized exchanges and ransomware assaults reaching recent heights, in step with a mid-365 days file from blockchain analytics agency Chainalysis.

Crypto Crime Traits Shift as Hackers Aim Exchanges

Whereas total illicit activity on blockchain networks has dropped by nearly about 20% 365 days-to-date, two lessons derive bucked the fashion: stolen funds and ransomware. Inflows from stolen funds nearly about doubled to $1.58 billion, up from $857 million in the same duration closing 365 days. Ransomware inflows rose approximately 2% to $459.8 million.

Notably, Bitcoin accounted for 40% of the whole transaction volume connected to these heists, up from 30% closing 365 days. This shift appears to be like pushed by attackers targeting centralized services that typically exchange BTC, such because the $305 million hack of exchange DMM.

This exchange’s example, primarily based mostly on files from the Cyvers file, showed that 3 out of 4 crypto thieves run unpunished, and most effective 24% of stolen cryptocurrencies are recovered and returned to the victims.

“The surge in Bitcoin’s fee will derive made crypto extra ideal to hackers, nonetheless opposite to ChainAnalysis’ recent findings, price is accurate one minute component,” James Toledano, the Chief Operating Officer at Savl, a self-custodial crypto and Web3 pockets, commented for Finance Magnates.

“Cybercriminals are changing into extra technically sophisticated as a consequence of AI. This worthy instrument with broad computing energy has been unleashed and is on hand to anybody, very much reducing the timeframe for hacking. There would possibly perhaps be an ‘fingers bound’ between attackers and defenders and this would possibly perhaps well most effective bag worse.”

It be price noting that the fee of funds stolen this 365 days has nearly equaled the whole for all of 2023. In accordance with a file from Chainalysis seven months ago, closing 365 days’s crypto hacking losses amounted to $1.7 billion, losing by extra than half of from the $3.7 billion reported in the file 365 days for fraudsters, 2022.

This is moreover very much extra than what modified into as soon as reported for the first six months of this 365 days by CertiK, which acknowledged that crypto losses amounted to $1.19 billion.

📣 Part 1 of our mid-365 days #cryptocrime update is right here! 🔎 Illicit on-chain activity dropped by nearly about 20% YTD, nonetheless stolen fund activity is surging and ransomware payments are breaking records. Read our weblog for a detailed evaluation. https://t.co/WRGG91mpFP

— Chainalysis (@chainalysis) August 15, 2024

Ransomware Payments Surge

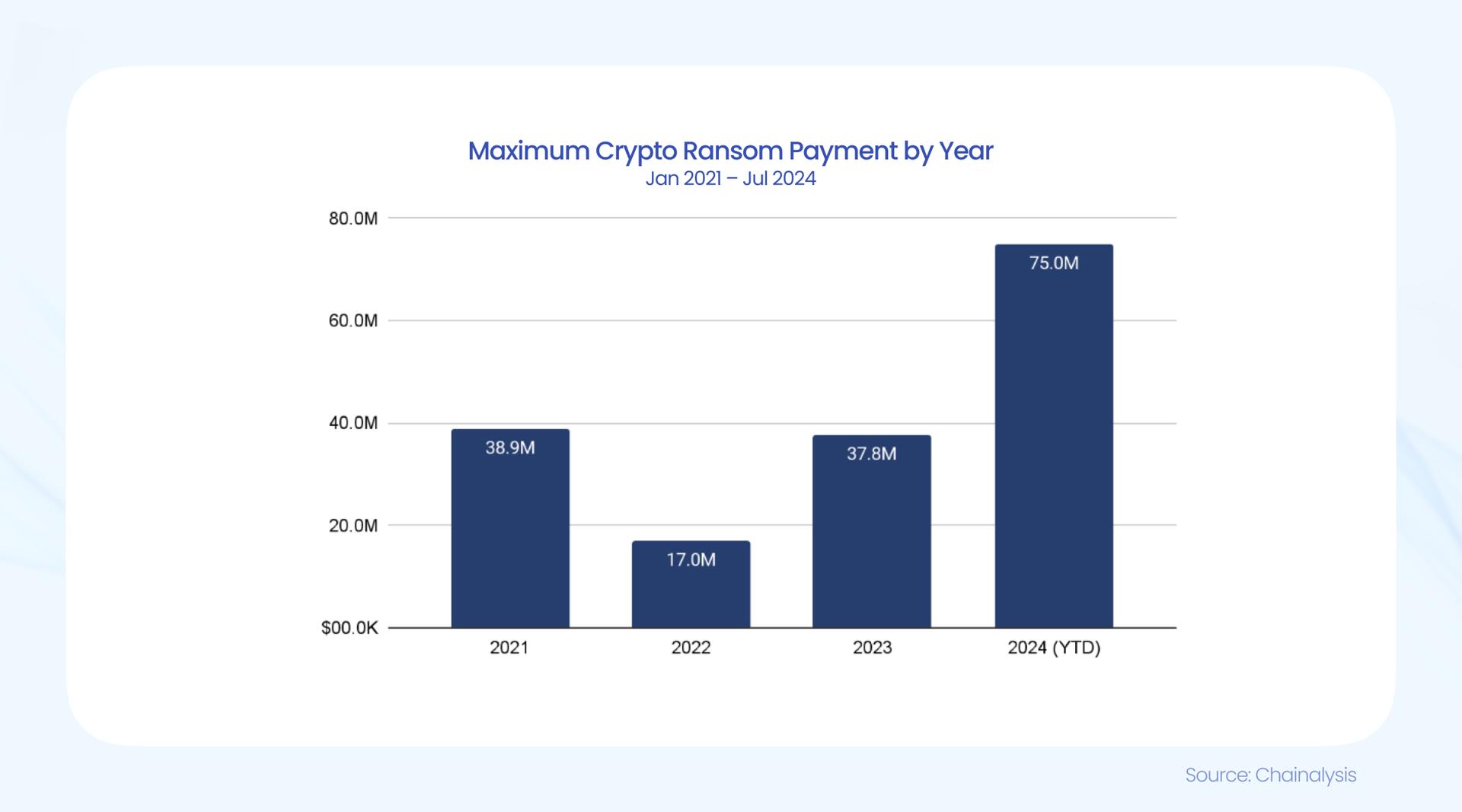

Ransomware assaults are heading in the suitable route for a file-breaking 365 days, with 2024 already seeing the largest single fee ever recorded at approximately $75 million to a community recognized as Darkish Angels. The median ransom fee to primarily the most severe lines has spiked from accurate below $200,000 in early 2023 to $1.5 million in mid-June 2024.

We are in a position to verify that early this 365 days we observed the largest ransomware fee ever at $75M. The “astronomical game hunting” fashion we discussed in our 2024 crime file – fewer assaults on larger targets with deeper pockets – is changing into extra pronounced. https://t.co/Z0yvg3Zvp2 pic.twitter.com/4FsivojtA5

— Chainalysis (@chainalysis) July 30, 2024

“A mountainous sequence of novel ransomware groups derive joined the fray, showing recent strategies and ways to raise out their assaults,” Andrew Davis, the Long-established Counselt at Kiva Consulting, current.

Despite the rise in assault frequency and severity, there is a silver lining. Whereas ransomware incidents derive increased by 10% 365 days-over-365 days, total fee occasions derive declined by 27.29%, suggesting improved victim preparedness and resilience.

Files on the growing sequence of ransomware assaults is moreover confirmed by ZScaler’s Train of Ransomware File, which acknowledged that in 2023, the frequency of such actions increased by 73%, and the whole payout surpassed over $1 billion. The assaults were largely eager on the FX sector and cryptocurrencies.

“Moreover, or no longer it is miles a need to derive to reward that the proportion of hacks is grand lower than with TradFi so we mustn’t be so fleet to demonize DeFi as being rampant with hacks,” added Toledano. Within the united states on my own, shoppers lost $10 billion to monetary scammers in 2023.